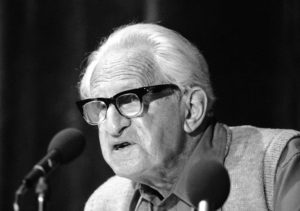

Steve Fraser on the Crisis of Capitalism

Does the prospect of deepening economic meltdown and political disarray raise the specter of a social upheaval and, perhaps, the collapse of capitalism, the likes of which we haven't seen since the Great Depression?Does the prospect of deepening economic meltdown and political disarray raise the specter of a social upheaval and, perhaps, the fall of capitalism?

On a mid-December day in 1932, ex-President Calvin Coolidge confided to a close friend, “We are in a new age to which I do not belong.” He punctuated that insight a few weeks later when he died.

History has confirmed Coolidge’s premonition. The Great Depression and the New Deal are considered watershed events in America. Only the Civil War had a more profound effect on the character of American society and on the nature of its political culture and political economy. Only the trauma of the Civil War left behind memories even more enduring than those associated with the cataclysm of the Great Depression. One speaks of antebellum and pre-Depression America to signify how different the country looked before the abolition of slavery and the advent of the New Deal. Both moments are rightly identified with the passing away of an ancien régime and the birth of a new order of things.

Today virtually every reflection on the nature of the current global financial collapse and what, for the moment at least, is being called the “Great Recession” invokes the specter of the first Great Depression and the promise (or for some the threat) of the New Deal. Is our dilemma like that one, as severe or less so? Will it reform or even revolutionize public policy? Does it call capitalism itself into question? Should we expect the kind of social upheaval that made the 1930s so unforgettable? Will it go down as a turning point in American political history the way the elections of 1860 or 1932 did?

Every early-on-the-ground indication suggests otherwise. The first 100 days (now as I write the first 200 days and counting) of the Obama administration are a failure. At least that’s so when they are measured against the only other first 100 days anyone really cares about, namely Franklin Roosevelt’s. Those famous few months compacted together an extraordinary legislative/executive response proportionate to the unprecedented dilemma facing the country even if those responses were not always consistent, coherent or effective. It included a national bank holiday and law guaranteeing bank deposits, an “Economy Act” severely slashing government expenditures, legislation separating commercial from investment banking, two recovery acts aimed at reviving industry and agriculture, a securities bill to bring the stock market under public scrutiny, an agency that saved hundreds of thousands from foreclosure and eviction, a lightning-fast work relief program, a major infrastructure-building project, and an unprecedented federally directed effort at regional economic planning and development. The atmosphere was electric with a sense of alarm, anger and accomplishment. Walt Disney’s “Three Little Pigs” cartoon debuted in 1933 to wild popular enthusiasm because it seemed to allegorize the country’s plight: Its regrettable recklessness during the intoxicated devil-may-care Jazz Age ’20s, its rediscovery of the virtues of frugality, and its determination to confront the “big bad wolf,” those Wall Street financiers who had laid the country low.

Matters couldn’t seem more different now. On every major issue from health insurance to financial regulation, from energy policy to foreign policy, from economic recovery to labor law reform, the new regime and its sizable majority in Congress equivocate, seek allies on the right where there are none, and convey a sense of paralysis. If top officials talk plenty about historic opportunity, they seem incapable of seizing it. On the contrary, after some official verbal rebukes directed at the financial oligarchs responsible for the crisis, the “big bad wolf” has so far escaped unscathed; indeed the “bailout” state has resuscitated those “too-big-to-fail” institutions on extraordinarily generous terms at taxpayer expense and left them largely under the old management, which continues to reward itself with unseemly sums for its repeated failures.

Despite the sluggishness and ambiguity of these dolorous 200 days, it is still tempting to view the global crash and election of 2008 as one of those rare turning points. And in some sense it is. That someone of Barack Obama’s racial origins occupies the presidency speaks volumes. Thanks to the debacles of the final Bush years, the political demography of the country has shifted dramatically, shrinking the electoral map for the Republican Party to the Old South and portions of the Mountain West and Great Plains. If the country’s financial overlords continue to wield enormous power, their moral stature approaches zero and their faith in the free market now seems like a cultic delusion, damaging to their intellectual credibility. Ideas about government regulation and government economic stimulus, so recently anathematized, are now mainstreamed.

Yet something more profoundly disillusioning has emerged. Even as the atmospherics of the Obama phenomenon promise a daring break with the old order –“yes we can”– the new regime seems a captive of a more distant past. Its political imagination extends no further than the New Deal and often not even that far. Rather than revolution, it seems more often to be talking about restoration. This is strikingly at odds with the expectations normally associated with previous turning points in U.S. political history.

Beneath its surface electoral hurly-burly, the United States has enjoyed a distinctly placid political life. Most of the time, its two-party system has effectively proscribed serious alterations in the prevailing political economy, the balance of power among social classes, the regional distribution of wealth and influence, and the fundamental direction of public policy. Only on rare occasions has the country’s political equilibrium been stressed enough to rupture and open up the possibility of some entirely new order: a new reigning ideology, a new political demography, a new relationship between government and civil society, a new distribution of wealth and income. Three such moments stand out: the elections of 1860, 1896 and 1932. The first abolished slavery, the second promised but failed to replace tooth-and-claw industrial capitalism with a Populist vision of the cooperative commonwealth, and the third succeeded in supplanting laissez-faire industrial autocracy with an American version of social democracy, or what might be called the Keynesian commonwealth.

All three of these turning-point elections were distinguished by a pervasive and concrete sense that American society might look like quite a different place as a consequence. Visions of a new order—one of “free soil, free labor, free men” in the case of Lincoln’s victory, one in which mankind would no longer be “crucified on a cross of gold” should William Jennings Bryan actually win the presidency, one that would chase “the money-changers from the temples of our civilization” as vowed by FDR in his first inaugural address—are what made these elections so thrilling, so fraught, so feared by some and so passionately embraced by others. These visions of a new way of life had gestated for a long time inside the old society. In all three cases, a general crisis of the ancien régime—disunion, a revolt of the producing classes, and the Great Depression—turned great expectations into real political flesh and blood.Arguably, we confront another general, societywide and global crisis now. But after sweeping away the bathetic verbiage of the Obama campaign—a rhetoric that after all always remained elusively vague about just exactly what we were supposed to make of “change we can believe in”—the cupboard is bare. What we are witnessing is the exhaustion of political imagination and an associated failure of will. The far horizon of the new regime amounts to a tepid version of the New Deal. And that view is really only articulated by the doggedly loyal left-liberal and labor supporters of the administration. The Obama inner councils rarely venture even that far, so anxious are they not to scare away “blue dog” Democrats, Republican “moderates” (scarce as hen’s teeth) and, most of all, the financial oligarchy. “Change we can believe in” turns out to mean—at least so far—some version of back to the future; either some bowdlerized, stripped-down imitation of the New Deal or a regurgitation of the finance capitalism that just collapsed, or some grotesque combination of both.

“Market Keynesianism,” a term invented by the historian Robert Brenner, defines the claustrophobic confines within which administration policy wonks and allied intellectuals function. Books like “Animal Spirits” by George Akerlof and Robert Shiller and “Nudge: Improving Decisions About Health, Wealth, and Happiness” by Richard Thaler and Cass Sunstein are recent articulations of a subset of market Keynesianism known as “behavior economics.” These books can sometimes be scathing in their dissection of the recklessness, irrationality, hubris and malfeasance of Wall Street’s elite institutions. And they are often unsparing in their indictment of somnolent regulators, to the degree there was any regulation at all. But they veer away from unearthing any systemic pathology.

On the one hand, they dismiss free market utopian fables about the self-regulating marketplace. And they acknowledge the tendency to irrational behavior, something which orthodox economists, who maintain a credulous faith in rational expectations and efficient markets as the way the real economy works, can’t seem to abandon, even in the teeth of the most overwhelming evidence to the contrary. But these “market Keynesians” still treat the understructure of market society—its axiomatic belief in the self-interested individual—as genomic.

“Behavioral economics” is aptly named because it is singularly focused on the social psychology of economic behavior. Economics in this case devolves into group psychoanalysis. In this view, it’s not that the recent smashup is some figment of the imagination, but that some figment of the imagination (“irrational expectations,” for example) made things go smash.

“Behavioral economics” takes on a “Keynesian” coloration because it invites the government to intervene with a series of incentives and disincentives that it hopes will “nudge” people—bankers as well as bakers—to behave more like rational members of the species Homo economicus. Theorists and practitioners of “behavioral economics” seek to avoid a more root-and-branch assault on the structures of power and wealth and the money culture that got everybody into this mess, while they simultaneously rehabilitate the levers of public authority to fine-tune and restore the operations of the market. The elaborate network of government loans, subsidies, exemptions and equity contributions offered up to the country’s banks and “shadow banking” institutions, heroic efforts to keep “zombie” banks upright, first initiated by Henry Paulson and ever more ingeniously extended by Timothy Geithner and Ben Bernanke, might be considered a practicum in “behavioral economics.” It is designed to nudge financiers to act more responsibly without disturbing the basic proprietary and power relations of the old financial order.

One inventor of this new persuasion describes it as a form of “libertarian paternalism.” How wonderfully apt! “Libertarianism” offers reassurance that nothing is meant to threaten the axiomatic individualism of capitalist society; “paternalism” that a beneficent, knowing elite is at the controls, such as they are. It suits perfectly the political isolation chamber in which the new regime, for the moment at least, seems to reside. That regime wants to stand above the fray, disdainful or afraid of the passions ignited by the meltdown, sure of itself and of its technical intelligence to put things back together again; in a word, rule by “brainiacs,” a politics of the apolitical. For all of its electoral robustness, there is something ephemeral about the Obama coalition in its failure to engage or its deliberate damping down, so far anyway, of the social energies released by the collapse of the neoliberalism of the Reagan epoch.

Is this picture so different than what things looked like during the decade of the first Great Depression? Yes and no, but in the most important ways, decidedly yes. Like today, back then a ton of literature exposed the intricacies of the Great Crash, the inside-trading shenanigans associated with investment trusts and pools, the confidence-man trickery gulling people to invest in “Peruvian bonds” (the subprime mortgages of that time), the heavily leveraged stock speculation and Florida real estate bubbles which associated the stock market in the popular mind with the sensual abandon of bootleg gin, the flapper and jazz. But there was in addition a greater thirst for more probing hypotheses of why everything fell apart.

Seventy-five years ago the universe of political possibility was still expanding. When the Great Depression spread from America to Europe and then back to the United States with the bankruptcy of the Austrian Credit Anstalt and Britain’s abandoning the gold standard in 1931, many were ready to conclude that capitalism had failed. Such thoughts could show up in the oddest quarters. Irving Fisher was the most renowned economist of the 1920s but survives in popular memory as an object of ridicule because he made the terminally bad choice to pronounce that stocks had reached “a permanently high plateau” just days before the Crash of ’29. By 1933, however, Fisher had published “The Debt-Deflation Theory of Great Depressions,” a seminal article that showed how deflationary spirals, driven by over-leveraged speculative investment, could turn into intractable depressions. If dire circumstances could move even someone as improbable as Fisher to acknowledge the possibility of capitalism’s failure, others arrived at that position effortlessly.Socialists, of course, believed that, but what is worth remembering is that even in the United States, a broadly anti-capitalist culture—partly socialist, partly antitrust, partly populist and newly reinvigorated by the communist movement—was alive and well. It was ready to contemplate doing something more daring than rearranging the deck chairs on the Titanic. The Soviet Union still seemed an inspiring experiment in labor emancipation. Karl Marx was still a name to reckon with. For many, the proletarian metaphysic remained the animating logic of historical progress. Mainstream magazines like The Atlantic, Harper’s and Scribner’s placed capitalism on trial and seriously contemplated the immanent prospect of revolution. Talk of granting dictatorial powers to the new president to meet the emergency, some of it inspired by FDR himself, entered respectable conversation, looked upon favorably by people like Walter Lippmann. The vocabulary and grammar of the nation’s political culture still made room for notions of class conflict, plutocracy, “malefactors of great wealth” and “the money trust.” Speculators still gave off a sulfuric aroma. The horizon of political debate extended far enough to embrace Upton Sinclair’s “production for use” Democratic Party gubernatorial campaign to “End Poverty in California” and farmer-labor parties in the Midwest as well as the “Share the Wealth” populism of Huey Long, the flamboyant senator from Louisiana, and the Christo-fascism of Father Coughlin, the “radio priest” from Royal Oak, Mich., who mesmerized millions each week with his broadcasts denouncing Wall Street and eventually the Jews.

Rereading FDR’s first inaugural address in light of Obama’s is an exercise in moral numbing. Despite or perhaps because of his privileged social origins—descendant of Colonial-era Hudson River landed gentry—Roosevelt invoked a language of moral censure aimed at the country’s socially irresponsible financial elite. He excoriated the “money-changers” who “have fled from their high seats in the temple of our civilization” because “they know only the rules of a generation of self-seekers. They have no vision, and where there is no vision, the people perish.” He condemned the “mad chase of evanescent profits” and the systematic plundering of “other people’s money.” Despite or perhaps because of his quite different social origins, such morally charged, class-inflected rhetoric was largely missing from Obama’s first inaugural. Instead, there was a misdirected effort at collective blame for the country’s economic predicament and an uninspired invocation of national unity.

Rhetoric is only rhetoric. Recent histories of Roosevelt’s first 100 days by Jonathan Alter (“The Defining Moment”) and Anthony Badger (“FDR: The First 100 Days”) make clear that FDR, like Obama, worried about alienating big business. According to one congressional observer of FDR’s maiden performance, “The President drove the money-changers out of the Capitol on March 4—and they were all back on the 9th.” Still, rhetoric, especially when enunciated by the president, helps define the outer boundaries of the politically possible and permissible. That’s why for some, Roosevelt and the New Deal seem even now “socialistic.”

Keynes was not a socialist. “I can be influenced by what seems to me to be justice and good sense; but the class war will find me on the side of the educated bourgeoisie,” he once said. He was not even comfortable with nationalization, nor, as Robert Skidelsky points out in a new book (“Keynes: The Return of the Master”), did he contemplate large government deficits. However, what Keynes did offer was a general theory of capitalist collapse. It pointed to under-investment and under-consumption, aggravated by gross inequalities in the distribution of income and wealth, and further burdened by the exactions of a rentier class of financial and stock market speculators. Capitalism, Keynes argued, was inherently unstable, not a system tending toward some optimal equilibrium; rather the abnormal was normal. Moreover, even if there might be some absolute bottom to any economic depression, that did not mean that once reached, recovery would return the economy to its previous high point. On the contrary, without some deliberate contravening action, the reproduction of economic life could proceed at some considerably lower level for a long time. Those are words to conjure amid all the current sightings of “green shoots” of economic good times ahead.

Keynes cultivated a rich contempt for the whole notion of “economic man,” the obsessive love of money, the pursuit of wealth as a worthy end in itself. When Roosevelt took office and decried “the old fetishes of so-called international bankers,” Keynes pronounced him “magnificently right in forcing a decision between two divergent policies.” Another new book about Keynes, by Peter Clarke (“Keynes: The Rise, Fall, and Return of the 20th Century’s Most Influential Economist”), quotes the Cambridge don excoriating money lust as “a somewhat dispiriting morbidity, one of those semi-criminal, semi-pathological propensities which one hands over with a shudder to the specialists in mental disease.”

Except for an occasional piety uttered in or out of church these days, such an attitude would be treated as embarrassingly wooly-headed by our temporizing techno-economic cognoscenti, or for that matter by much of today’s popular culture. Back then, however, Keynes’ moral-ethical criticisms didn’t seem so remarkable, not in a world that still took socialism, Christian socialism, papal condemnations of Mammon worship and Catholic corporatist theology seriously. Indeed, Keynes interdicted usury; not as some vestigial throwback to the Middle Ages, but as an intrinsic aspect of the savings glut that had, in his view, brought the global economy to its knees. He even believed in some notion of the “just price,” a measure of value connected to the production of useful things , rather than market exchanges whose prices were in the Cambridge economist’s views not necessarily “just.” So, too, Keynes enumerated all the tragic wastes that trailed in the wake of risk; how out of tune that now sounds given our own era’s infatuation with the “risk society.”

Questioning the viability of unadulterated capitalism endured for some time, past the point when it was already being put back together again. The labor movement, which provided much of the social energy driving the New Deal to the frontiers of social democracy, continued to do that during and for a few years following World War II. It struck en masse in 1945-46 and marshaled its forces to fight for universal health insurance, for an equitable national incomes policy regulating prices, wages and profits, and government planning, public ownership, and a guarantee of full employment. It was even so audacious as to propose a permanent role for the labor movement in the running of particular enterprises and the economy as a whole. Then it succumbed to the toxic atmosphere of McCarthyism in which the country came around to thinking of free speech, racial justice and economic equality as communism.Likewise on the intellectual front, the interrogation of capitalism continued for a while after the New Deal years. Joseph Schumpeter, the conservative Harvard-by-way-of-Austria economist who was envious of all the attention paid to Keynes, opened Part II of his recently reissued 1942 book on “Capitalism, Socialism, and Democracy” by asking, “Can capitalism survive?” and immediately answered, “No, I don’t think it can.” Schumpeter championed the entrepreneurial spirit and the process of “creative destruction” which powered technological and social progress, and found Marxist economics intellectually bankrupt. But he, like Marxists and so many other thinkers of that era, wrestled with the internal structural dynamics and contradictions of the economy and accepted the pivotal role of social classes in determining how the system evolved. Most of all, he felt compelled to reckon with the likelihood of alternatives to capitalism, even if he didn’t like them and even if he believed they might triumph thanks to capitalism’s successes, not its failures.

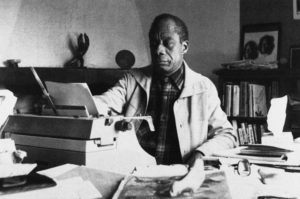

A bit more than a decade later (in 1955) and from the other shore, John Kenneth Galbraith published what is probably still the most popular account of the Great Crash (“The Great Crash, 1929”). Galbraith was there at the creation, working in the Agriculture Department during the earliest years of the New Deal and later on for the Office of Price Administration during World War II. His book, while duly noting the record of greed and incompetence that typified the period leading up to the crash, refused to leave it at that. He looked for underlying causes to explain not only the collapse but why it lasted so long. The last chapter of “The Great Crash” cites the maldistribution of income and the ensuing crisis of under-consumption, deformations in the structure of corporate America which invited the parasitical leeching away of productive investment, vulnerabilities in the banking network, imbalances in global trade and finance that left European and Latin American economies too dependent on the U.S., and finally a government intelligentsia still the captive of “sound money” and “balanced budget” orthodoxies.

In the decades following the publication of “The Great Crash,” Galbraith would come to occupy an increasingly solitary position as the last of the Keynesians; last, that is, in his persistent and probing criticism of the institutional, structural and moral deficiencies of the postwar political economy. Since then, whole lines of thought—socialism, Keynesianism a la père, economic populism—have become endangered species, living on the margins of public life. Losing these languages is crippling, a tragedy really, like losing a limb or a vital brain function. This withering away of the political imagination threatens to turn the great expectations of the Obama victory into a tale of two cities.

Every day the media puts on display the official schizophrenia about the current crisis. On the one hand, recovery beckons; it’s about to start, it’s already started, the crisis is over. People in charge—Bernanke, Geithner, Obama himself—are quoted to this effect. Evidence accumulates mainly in the financial sector, where big banks have so much cash on hand that some have paid back the government its bailout money and others are begging to do so. Profits in the FIRE sector [finance, insurance and real estate] are back, lavish bonuses are back: Can a third gilded age be far behind?

But then there’s the other kind of story, the one about the spreading misery of joblessness, foreclosures, homelessness, wage cuts, furloughs, brute amputations of social services, repossessions, bankruptcies, defaults—the dispossession of a dream. A tale of two cities indeed!

It ought to be seen as appalling, arrogant, callous, myopic, credulous and maybe most of all morally embarrassing to talk with a straight face about recovery amid all this. What could that word possibly mean; why don’t the bankers, their house intellectuals and the always deferential media choke on the word as they utter it? Who exactly is recovering? What, after all, is the whole point of economic recovery if it doesn’t first of all mean some improvement in general well-being? What is it that licenses this official complacency, which, in a kind of reassuring afterthought, notes that unemployment and other downbeat news may linger for a while, even quite a while, may even grow for a while, or for quite a while, but then again looks at Goldman Sachs and takes heart?

What allows for this is a long generation of financialization of the economy. Among the many lamentable legacies of that profound economic makeover is this kind of moral and cultural numbness. Economic good health, the notion of prosperity itself, has for a long time now been identified with how things are faring for the banks, the insurance companies, the hedge and private equity funds, their law firms and the legions of satellite enterprises that service that sector. This was always delusional, not just after Bear Stearns and Lehman Brothers sent up their distress signals.

The standard of living for broad stretches of Middle America has stagnated or declined for 30 years and more; that is to say, during the reign of high finance. After all, the de-industrialization of the heartland has been under way for a very long time, leaving behind ghost towns and human wreckage. The ballyhooed prosperity of those decades was always a hollow one, hiding inside an uglier truth detectable in shuttered factories and moribund unions, in national health and educational indices that left the United States trailing badly when compared with much of the rest of the industrialized world, in grotesque inequities in the distribution of wealth and income last seen nearly a century ago, in the treadmill race of two wage earners trying to bring home an income to match what used to be made by one, in its shoddy and sometimes lethally neglected bridges and flood walls and slow-motion trains, in its growing dependence on low-wage, sweated labor, both immigrant and native-born, in the “booming” retail and service sectors, in the way its mass consumption rested on the super-exploitation of working people in the global south, and what finally proved to be an insupportable burden of debt here at home.Moreover, the point of all this is not merely that we’ve now arrived at a tale-of-two-cities moment, when it’s the best of times for the bankers and the worst of times for the rest of us. It is rather that all along that faux prosperity rested on, depended on the inexorable erosion of other avenues to economic well-being. Some of us grew richer not only while but because a lot of the rest of us grew poorer.

Perhaps the greatest gulf separating the Great Depression from the Great Recession is the difference between the political economy born back then and the political economy of the last generation. The New Deal articulated the outlook of a new order based on mass consumption industrial capitalism. It was rooted in emerging sectors of mass production and distribution as well as in the insurgent labor movement and among broad circles of social welfare reformers. It helped give birth to a high-wage industrial economy buoyed by strong unions, an expanding system of social welfare, a regulatory regime to dismantle that era’s “money trust” and so open up the sluice gates of private capital and credit, and government pump-priming when called for. Some of the reform legislation of FDR’s first 100 days (the Securities Act, the Glass-Steagall Act, the TVA) and much more of the legislation to follow (the Wagner Act, Social Security, the Securities and Exchange Commission, the Public Utility Holding Company Act, the Fair Labor Standards Act, and so on) were designed, by no means always successfully, to bring this new, consumer-oriented industrial capitalism into being.

The New Deal was no utopia. It left untouched gross racial, gender and economic inequities, still deferred to the power of an industrial-financial-military elite, and committed itself to empire-building abroad. Nonetheless, for a generation it closed the gap between the haves and have-nots and kept alive the hope that much more in the way of economic and social justice might be accomplished.

Since then—beginning with the Reagan years—finance has triumphed over the New Deal industrial order. Financialization, or what some have called financial mercantilism, triumphed by gutting the American industrial heartland. That is to say, the FIRE sector not only supplanted industry but grew at its expense and at the expense of the unions, the high wages, and the capital that used to flow into productive investment, not to mention at the cost of government social supports and government regulation that comprised the understructure of New Deal capitalism. Think back only to the days of junk bonds, leveraged buyouts and asset stripping in the 1980s. What was getting bought out and stripped so as to support the exorbitant interest rates commanded by those high-risk junk bonds was the material wherewithal of the American economy and the millions who depended on it for their lives and livelihoods.

So today instead of unionized, high-wage industry, there is Wal-Mart. Our political economy is driven by “I banks,” hedge funds and the downward mobility and exploitation of casual labor, while industrial investment has been exported to the global south. This may account for the abject reliance of the Obama regime on the financial oligarchy and its intellectuals. It is a telling commentary on this great transformation of the past 75 years that Obama’s first 100 days did not feature at its core an industrial recovery act as FDR’s did. Instead, most attention is directed at restoring the well-being of the FIRE sector whose health is everybody else’s disease.

Will those “green shoots” of recovery flower? Perhaps. But so long as we remain in thrall to high finance, that’s a sobering thought. By extending the bailout state inaugurated by George W. Bush and Henry Paulson, the Obama administration assumes a heavy burden. One might call it the president’s own “moral hazard.” Determined at apparently any cost to keep those “too-big-to-fail” zombies alive and well, he licenses them to behave exactly as they have behaved for a quarter-century and more. Why not behave that way, if they are being reassured by Washington that at the end of the day there is no end of the day? And the latest indications are that they are doing precisely that, leveraging new, speculative paper transactions that help nobody but themselves.

More profoundly disturbing is this: Even should those “green shoots” flower, the best that can be expected is a kind of jobless “recovery” and a general lowering of the social wage. After all, recovery of the economy of high finance is not recovery we can believe in, nor is it even an economy. If this happens, then we may have to conclude that the Great Recession gave way to the Great Retrogression.

Steve Fraser is the author of several books, including “Every Man a Speculator: A History of Wall Street in American Life,” “Labor Will Rule: Sidney Hillman and the Rise of American Labor” and, most recently, “Wall Street: America’s Dream Palace,” published by Yale University Press.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.