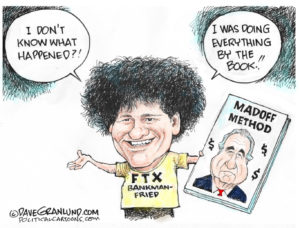

SEC Missed Multiple Opportunities to Bust Madoff

It was a sad case of too little, too late when it came to the Securities and Exchange Commission's readings of Bernie Madoff's now-collapsed house of cards. On Wednesday, the SEC released a report about Madoff's massive financial boondoggle, detailing the many moments in which chances were missed to stop the damage from spreading as far as it did.

It was a sad case of too little, too late when it came to the Securities and Exchange Commission’s readings of Bernie Madoff’s now-collapsed house of cards. On Wednesday, the SEC released a report about Madoff’s massive financial boondoggle, detailing the many moments in which chances were missed to stop the damage from spreading as far as it did. –KA

Your support matters…BusinessWeek:

“[D]espite numerous credible and detailed complaints, the SEC never properly examined or investigated Madoff’s trading and never took the necessary, but basic, steps to determine if Madoff was running a Ponzi scheme,” Inspector General H. David Kotz said in the report. “Had these efforts been made with appropriate follow-up at any time beginning in June of 1992 until December 2008, the SEC could have uncovered the Ponzi scheme well before Madoff confessed.”

The investigation found that between 1992 and 2008, the SEC received six credible complaints that “raised significant red flags” about Madoff’s operations and was also aware of two articles in business publications, published in 2001, that raised questions about Madoff’s remarkably consistent returns. The SEC conducted three examinations and two investigations of Madoff during that time period, but either accepted Madoff’s explanations or failed to follow up on questions and inconsistencies in the information the agency was given.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.