Prosecutors Use Patriot Act to Shut Down Virtual Currency Operator

Liberty Reserve, which, until Tuesday, operated a virtual currency that could be exchanged for cash, stands accused by the United States of laundering $6 billion in criminal funds.

Liberty Reserve, which, until Tuesday, operated a virtual currency that could be exchanged for cash, stands accused by the United States of laundering $6 billion in criminal funds.

The Treasury Department said the company was “specifically designed and frequently used to facilitate money laundering in cyber space.” According to Reuters, at least five people have been arrested in Spain, New York and Costa Rica, where the company was apparently based (Costa Rican prosecutors said the company was not operating legally).

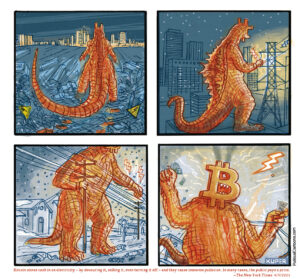

The best known virtual currency is Bitcoin, but unlike Liberty Reserve, no central authority governs Bitcoins. Instead, users can exchange Bitcoins with each other or buy them from other entities. Currently, one Bitcoin is worth about $130.

So how does the United States have the authority to shut down a foreign-based virtual currency? According to Reuters, the Patriot Act empowers the Treasury Department to take aggressive action against accused money launderers.

Reuters:

The U.S. Treasury Department’s anti-money laundering unit, the Financial Crimes Enforcement Network (FinCEN), issued guidance in March that labeled digital currency firms as money transmitters, thereby obliging them to put in place anti-money laundering programs and register with FinCEN.

Tokyo-based Mt. Gox, a top exchange for Bitcoin, the best known virtual currency, failed to register with FinCEN earlier this month and had its U.S. dollar accounts seized by authorities.

— Posted by Peter Z. Scheer.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.