Private-Prison Executive Predicts More Profits, Downplays Criminal Justice Reform

A senior executive with the second-largest for-profit prison company in America told investment bankers last summer that, talk of drug policy and criminal justice reform notwithstanding, the United States will continue to “attract crime,” generating new “correctional needs.” ePi.Longo / CC BY-SA 2.0

ePi.Longo / CC BY-SA 2.0

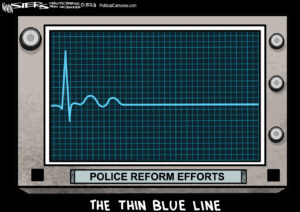

A senior executive with the second-largest for-profit prison company in America told investment bankers last summer that, talk of drug policy and criminal justice reform notwithstanding, the United States will continue to “attract crime,” generating new “correctional needs.”

“The reality is, we are a very affluent country, we have loose borders, and we have a bad education system,” said Shayn March, vice president and treasurer of the Geo Group. “And all that adds up to a significant amount of correctional needs, which, thankfully, we’ve been able to help the country out with and states with by providing a lower cost solution.”

Lee Fang reports at The Intercept:

March told attendees at the conference that he was getting questions about drug offenses and sentencing guidelines, an issue he noted had been raised by Hillary Clinton on the campaign trail. “I got to be honest with you, there’s very few people I know, if anybody, who’s in prison for smoking marijuana. It doesn’t exist, guys. That’s not why people are in prison,” March said.

Rather than reducing incarceration rates, March told his audience that drug reform could have the “opposite effect” by increasing prison terms. Most drug-related sentences, he asserted, are the result of plea deals stemming from violent crimes, so if there isn’t an alternative plea arrangement, the only outcome defendants face is a sentence for the violent crime, which carries longer sentences. […]

March spent a significant portion of his talk downplaying the impact of criminal and drug justice reforms on his company’s business. But in its Securities and Exchange Commission filing, Geo Group disclosed to investors that the firm could be “adversely affected by changes in existing criminal or immigration laws, crime rates in jurisdictions in which we operate, the relaxation of criminal or immigration enforcement efforts, leniency in conviction, sentencing or deportation practices, and the decriminalization of certain activities that are currently proscribed by criminal laws or the loosening of immigration laws.” […]

[…] March told attendees that factoring in elderly care, immigrant detention, and expansion plans overseas, the company is sure to grow. “I think I started at GEO, our stock price … got down to $12.50. And if you factor in an apples-to-apples comparison to where we are today, our stock is well over $50 a share. So we have quadrupled our value in that six-year period.”

Read more here.

— Posted by Alexander Reed Kelly.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.