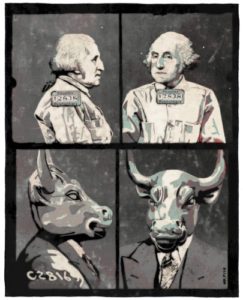

Paul Ryan, Corporate Darling

The bright-faced boy from Janesville and avowed man of the people has taken money from banksters, big insurance and the Koch brothers throughout his career, and has $5.4 million in the campaign chest -- $2 million more than the next highest House member.

The bright-faced boy from Janesville and avowed man of the people has taken money from banksters, big insurance and the Koch brothers throughout his career, and has $5.4 million in the campaign chest — $2 million more than the next highest House member.

Paul Ryan has taken $2.8 million from the finance, insurance and real estate industries over his congressional career for largely uncontested runs against candidates like unemployed reporter John Heckenlively, who spent zero dollars in his 2010 campaign against Ryan.

The insurance industry — which will win big if Ryan can turn Medicare into a privatized voucher program — and its employees have given Ryan a total of $815,328 toward his election efforts.

National banks and other finance companies that want to minimize regulation of their industry have given Ryan a total of $748,824 throughout his career. And the Koch brothers have given him $65,000 through their political action committee and the employees of Koch Industries, Ryan’s largest donor from the energy sector. Ryan’s budget promises $40 billion in tax breaks for big energy.

— Posted by Alexander Reed Kelly.

Your support matters…PR Watch:

Out-of-state Wall Street banks, securities and investment firms are second in industry donations to Ryan, giving him a total of $748,824 throughout his career, according to the Center for Responsive Politics. This election cycle, Wells Fargo, UBS, Goldman Sachs, and Bank of America are among Ryan’s top contributors. In 2012, Wells Fargo bank gave Ryan $12,150 while at the same time busily participating in an “explosion” of foreclosures in Ryan’s district.

Ryan not only voted for the $800 billion TARP bank bailout, he used his reputation as the Chairman of the House Budget Committee and one of Congress’ supposed bright lights to persuade his colleagues to do the same. “If we fail to do the right thing, heaven help us — if we fail to pass this I fear the worst is yet to come,” Ryan warned his colleagues in a clip that was featured in Michael Moore’s movie “Capitalism: A Love Story.”

But Ryan is not done helping out the Wall Street firms. His 2013 budget proposal would repeal aspects of the Dodd-Frank bill, which would allow the government to designate non-banks (like insurance firm AIG) as “systemically significant” and subject to new rules, such as the one that allows FDIC to break up or dissolve these “too big to fail” institutions in a crisis.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.