Obama’s Two-Year Economic Report Card

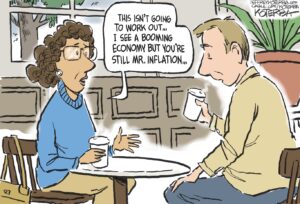

There are two potential ways to measure the economic performance of a political leader One is by the profitability, stock prices and executive bonuses of a nation’s corporations The other is by the financial condition of the majority of its population.

There are two potential ways to measure the economic performance of a political leader. One is by the profitability, stock prices and executive bonuses of a nation’s corporations. The other is by the financial condition of the majority of its population. Since he came to power, President Obama and his economic team have propped up the former and failed miserably to aid the latter. (For the record, ever since the first paragraph of Obama’s pre-primary website economics plan put free markets before people, this is where we were going, but it still hurts to get there.)

The S&P 500 index is up 50% since Obama took office. But unemployment remains higher than it was when he entered the White House, home foreclosures continue to mount to the detriment of borrowers and entire neighborhoods, health insurance companies responded to his health care “reform” bill by raising premiums, and the financial system’s largest banks continue to prosper in the wake of a multi-trillion dollar bailout with no strings attached to share their subsidizations with the rest of American citizens. To top it all off, as he approaches the midpoint of his first, and likely last, term, Obama bowed to the pressure of the Republican Party and extended tax cuts for the richest Americans in order to be able to also extend them for everyone else more sorely in need. There’s only so long you can blame another administration for your actions.

Obama’s economic policies have either been continuations of his predecessor’s, as in the case of taxes and bank bailouts, or bills so watered down to appease corporations, notably banks and insurance companies, that they are ineffective. In the process, he continues to alienate his supporters — individual voters, not the companies that funded his candidacy — leaving their economy in shambles. Here’s the recap.

Taxes

Just in time for Christmas, we got Obama’s big tax-cut compromise. Obama’s reverse Robin Hood deal with the Republicans disproportionally takes from the poor to give to the rich. The plan adds another $1 trillion to the record United States deficit, $700 billion of which would be the cost of extending tax breaks to the wealthiest 2 percent of the country, the rest going toward jobless benefits — necessary to help those victims of the wider economic problems, but not complemented with a job-creation program.

According to the Center on Budget and Policy Priorities, American millionaires would get 22 percent (or $200 billion over two years) of the benefits of the deal, while the bottom 20 percent of American workers would get less than one-half of one percent. According to David Cay Johnston, the 45 million households that make less than $20,000 a year will be slapped with a tax increase of $150 to $200.

Even though the majority of his own Democratic Party supported extending cuts only to Americans making less than $250,000 a year (on TV anyway, apparently not at their seats once the compromise was inked, notables with balls like Sen. Bernie Sanders aside), Republican “all-or-nothing” pressure was met by Obama’s capitulation. He could have bargained harder — say by suggesting that tax cuts not be extended for people making more than a million dollars, rather than punting the tax cut issue into the 2012 presidential election period.

What Obama effectively did was adopt George W. Bush’s tax policy in total rather than come up with a better deal, even though the Bush tax cuts increased the net worth of the wealthiest Americans while the wages of the rest of Americans (the ones that had jobs) stagnated or decreased per hour worked. The Republicans obviously considered the deal a victory, to hell with any Republican voters in the bottom 98 percent of the country. Wall Street thought it was better than expected. Jamie Dimon was all but salivating. Even though the majority of Americans wanted to end tax breaks for the wealthiest, plus extend unemployment benefits, Obama couldn’t pull it off.

Housing

Obama’s $75 billion Home Affordable Modification Program (HAMP) was an unmitigated disaster for the borrowers who tried to take part, despite his promises that it would help 3 to 4 million struggling borrowers keep their homes.

On Dec. 15, I spoke at a mortgage fraud seminar in Ontario, Calif., and, let me tell you, there’s more fraud going on in modification-land than there was in loan-origination-land. The next day, over in Washington, Tim Geithner spoke glowingly of everything the administration has done to help the financial system, gloating laboriously over the bells and whistles of the various asset purchase and loan extension bank bailout programs and how much money we taxpayers made as a result. As for borrowers — you know, the little people — he stressed the number of modification applications in the pipeline instead of actual permanent modifications. This was primarily because it was a voluntary program on the part of the banks, which had no incentive, economic or legal, to work with borrowers. In the meantime, 8 million to 13 million foreclosures are expected to have taken place from the time the banks got their bailouts until 2012. If you figure on average there are three people living in each home, we’re talking 24 million to 39 million displaced people.

I really wish Geithner could have been standing in front of the borrowers at the seminar I attended, if only to get a clue.

Half of the 1.4 million borrowers that entered the HAMP program were kicked out. Only 2 percent of the loan modifications so far have involved lasting principal reductions. Most of the rest were given temporary reprieve, only to see their payments rise at the end of their trial periods or their banks rush to foreclose on them anyway.

To fix this problem, Obama has just created a $14 billion principal reduction program – something that should have been done on a far grander scale about two years ago. It remains to be seen whether this will be any more effective than the larger initial program, since participation is equally voluntary on the part of lenders, notably the biggest five banks that control two-thirds of the nation’s mortgages. I’m not holding my breath. Unreformed Banking System

Throughout his presidential campaign and his first 18 months in office leading up to the passing of the Dodd-Frank so-called financial reform bill this summer, President Obama asserted that the crippled economy was predominantly the result of failures in the banking system.

He admonished bankers for their greed and vowed that those days were over. Never again. Blah, blah, blah. But, the financial reform bill that he championed stopped none of the risky practices of the most powerful banks. (If you want to buy a package of distressed mortgages, call any of them today.) Nor did it break them up into smaller, more easily regulatable entities. Indeed, the largest banks in the United States are now bigger and stronger than they were before the bailout, even as smaller banks continue to close, creating a far less stable banking environment than before the crisis.

Geithner, as Obama’s treasury secretary, remains an apologist for the bailout, and it was Obama who moved to reconfirm Ben Bernanke as head of the Federal Reserve instead of making good on his major promise of “change” in the financial system. That’s why Wall Street bonuses this year are expected to be 5 to 10 percent higher than last year, even though bank profits are lower and lending remains muted. Because things have changed so much.

Jobs

On the job front, the picture remains bleak, as everyone is keenly aware. Nearly 11.5 million people have lost their jobs since Obama took office, despite claims that the $787 billion stimulus package saved 3 million to 4 million jobs. The unemployment rate of 9.8 percent is 32 percent higher than the 7.4 percent rate it was before Obama was inaugurated, and it has steadfastly stood at that level throughout his term.

Even worse, the number of workers who have been unemployed for over six months remains the seventh-highest on record at 6.1 million. There are still 4.4 unemployed workers for every available job (compared to 2.8 workers per job during the early 2000s recession). Thus, one in six U.S. workers is either unemployed or underemployed, which amounts to nearly 26.8 million workers.

Meanwhile, corporate profits have jumped back to near-historical highs, and banks are hoarding an extra $1 trillion in reserve at the Fed instead of using it to restructure mortgages or lend to small businesses that could create jobs with the money. Obama’s administration has been unable to find a way to force more job creation by tying corporate and bank well-being to that of the greater economy, either because it can’t or doesn’t want to.

Health Insurance

There were 59 million Americans without any health insurance in 2010, up from 46.3 million, or about 15.4% of the population in 2009, which was a slight increase from 2008. That 27% increase in 2010 is the highest per year under any presidency.

Sure, Obama promised that his new health-care-so-called-reform bill would help when it takes effect in 2014 and expand coverage to more than 32 million uninsured Americans. Meanwhile, health insurance companies hiked premiums by 14% this year and dropped the amount of coverage they provide for those increases. Why? Because they can. At that rate, even people that do have insurance coverage will see their costs nearly double by the time the reform bill takes effect, because “reform” never capped the premiums insurance companies can charge, which is not a tiny omission. This while attempting to mandate that everyone purchase health insurance, a double gift for insurance companies, now being battled out in the courts for the constitutionality of the mandate, not the extortionist cost of health care and insurance.

Meanwhile, the top 10 health insurance company CEOs bagged $228 million in 2009, up nearly 162% from the year before Obama took office, and they anticipate even more for 2010 — and yet there are no major audits of their business practices on the horizon.

Citizen Sentiment

Despite his rhetoric to the contrary, Obama’s policies are far more pro-corporate than pro-populace, not a huge surprise, but still the reason that the Main Street economy isn’t improving. According to a Bloomberg survey from early December, more than 50 percent of Americans say they are now worse off economically than they were when Obama took office, a third think they are doing better, and two-thirds believe the country is headed in the wrong direction.

Those poll numbers, considering the weakness in the economy, aren’t necessarily horrible. President Ronald Reagan’s numbers were even worse after his first two years, and he still won his second term decisively. Plus, Obama inherited an abysmal economy, as he continues to remind us.

But just because you get on the train after it’s already rushing out of the station doesn’t mean you can’t find a way to stop it before it decimates a town or something bigger. The guys in the film “Unstoppable” ignored the dumb ranting of their suited bosses and saved the day. It can be done. (Go see the film; it’ll make you smile.)

A higher stock market is of little comfort to the millions of Americans who don’t have jobs, are facing foreclosure, fraudulent or otherwise, or have no health coverage. Equally, it’s of little comfort that, rather than finding the money to help this swath of citizens, the Obama administration added $700 billion to the deficit by giving the wealthiest Americans more tax breaks. Hell, if you’re gonna go for broke on the deficit, why not fight to spread that same $700 billion over the rest of the citizenry instead?

Obama’s economic priorities are primarily benefitting a small and influential part of the population, but they have not provided the rest of the country with anything to be optimistic about this holiday season. In that regard, he’s more Scrooge than George Bailey.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.