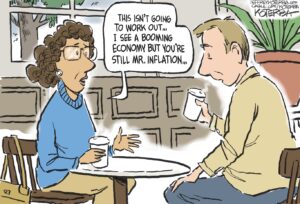

Nothing Has Changed on Wall Street

A year after Lehman Brothers went under -- taking a big chunk of the economy with it -- the deregulation and lax oversight that enabled the crisis are still a problem. According to this New York Times report, things might even be worse.

A year after Lehman Brothers went under — taking a big chunk of the economy with it — the deregulation and lax oversight that enabled the crisis are still a problem. According to this New York Times report, things might even be worse.

New York Times: “Senior regulators who stood idly by for years as financial firms built their houses of cards have been rewarded with even bigger jobs or are jockeying for increased responsibilities. The Federal Reserve Board, for example, wants to become the financial system’s uber-regulator, even though its officials did nothing as banks made deadly decisions to lend recklessly and leverage themselves to the max.” [Link]

That’s assuming lawmakers get any traction working against a financial industry that has gotten everything it wanted out of this government.

Regulation is crucial, but so are regulators who are willing to jeopardize networking opportunities to keep their wards in check. Eliot Spitzer once joked that his crusading efforts against Wall Street firms were costing him friendships. He was the exception. — PS

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.