No Moratorium on Foreclosures

The Obama administration isn't ready to help homeowners stay in their homes by imposing a moratorium on repossessions, even though some banks are stopping foreclosures and resales of foreclosed homes and concerns about mortgage fraud are growing.

The Obama administration isn’t ready to help homeowners stay in their homes by imposing a moratorium on repossessions, even though some banks are stopping foreclosures and resales of foreclosed homes and concerns about mortgage fraud are growing. –KA

Your support matters…BBC:

Amid claims that shoddy paperwork led to wrongful repossessions, calls have grown for a nationwide moratorium.

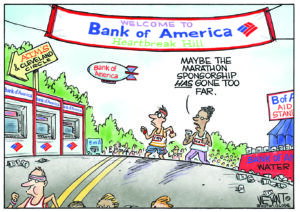

Last week, Bank of America said it would extend its ban on sales of repossessed homes from 23 US states to all 50.

JPMorgan Chase and Ally GMAC Mortgage have suspended foreclosures in 23 states.

At issue are claims that foreclosure documents were signed off without proper checks and people were wrongly evicted.

BoA is looking into whether homes were repossessed by so-called “robo-signers” and other automated processes, whereby mortgage company employees or their lawyers do not thoroughly verify the information in them.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.