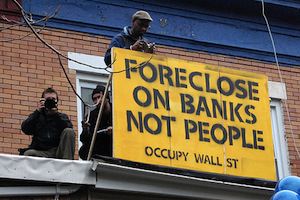

New York City Foreclosures Soar

Foreclosures in New York City rose 19 percent last year as filings fell nationally by 3 points, a new report says. Meanwhile, New York Attorney General Eric Schneiderman announced a meager $1.9 million settlement with a robosigning giant, reports Catherine Curan at the New York Post.

Foreclosures in New York City rose 19 percent last year as filings fell nationally by 3 points, a new report says. Meanwhile, New York Attorney General Eric Schneiderman announced a meager $1.9 million settlement with a robosigning giant.

The offending company, Lender Processing Services, which earned $290 million on revenues of $2.1 billion in 2011, had to pay a penalty roughly equal to the average sales price of a single Manhattan apartment, the New York Post reports.

The 13,116 foreclosed properties occurred mostly in Queens, which saw a 164 percent rise in filings, compared with a 1 percent increase in the Bronx and a 19 percent hike in Staten Island. Foreclosures fell 27 percent in Manhattan and 19 percent in Brooklyn.

— Posted by Alexander Reed Kelly.

Your support matters…Catherine Curan at the New York Post:

The $1.9 million is New York’s portion of a $121 million multistate deal with LPS and its subsidiaries, LPS Default Solutions and DocX, to settle for misdeeds (including robosigning), overhaul its business and fix mistakes.

Foreclosure experts called the payment stunningly inadequate and noted that faulty documents created by LPS and other firms in the past are still appearing in foreclosure cases. “It looks like a big number, but it’s truly a failing for the people in New York,” said foreclosure defense attorney Linda Tirelli. “I continue to find these documents every day.”

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.