Moody’s Downgrades Big Banks

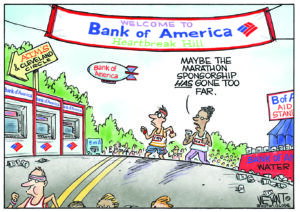

Moody's downgraded the credit ratings of three major U.S. banks Wednesday, and so far it appears that Bank of America was the hardest hit by the move.

Moody’s downgraded the credit ratings of three major U.S. banks Wednesday, and so far it appears that Bank of America was the hardest hit by the move.

The credit rating firm downgraded the debt of Bank of America, Citigroup and Wells Fargo after the FDIC argued that ratings companies shouldn’t have to include premiums for banks considered “too big to fail.”

Bank of America shares dropped 7.5 percent Wednesday, lower even than before Warren Buffett’s Berkshire Hathaway dumped $5 billion of capital into Bank of America last month. –BF

Your support matters…The Financial Times:

BofA noted that Moody’s “explicitly stated that the downgrades do not reflect a weakening of the intrinsic credit quality of Bank of America”.

But the rating agency did point to the hard-to-measure risk of BofA losing some of the mortgage-related lawsuits it faces, such as a $10bn claim from AIG, the insurance group, saying the outcome “could have a significant impact on [BofA’s] capital position” and the “resolution is not entirely within the direct control of management”.

BofA, the largest US bank by assets, had its long-term senior debt cut from A2 to Baa1 and its short-term debt cut from Prime 1 to Prime 2.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.