Mom’s Dreary Retirement Prospects

Not to ruin brunch, but Mom's probably not doing very well. Not if she's already retired, not if she's a baby boomer approaching retirement, not if she's a younger woman who hasn't yet given retirement a thought.Not to ruin brunch, but Mom’s probably not doing very well. Not if she’s already retired, not if she’s a baby boomer approaching retirement, not if she’s a younger woman who hasn’t yet given retirement a thought.

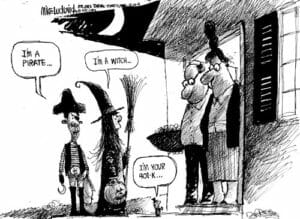

This Mother’s Day could stand fewer sweet greeting cards and more frank conversations about how mothers — and all American women — are going to be supported in old age.

They used to depend on traditional pensions that under the law protected surviving spouses, usually a widow, with lifetime monthly benefits. These pensions are becoming extinct. Then they were expected, like most American workers, to self-finance their retirement through 401(k) savings plans. But women live longer and earn less than men. Their lower pay means they can’t save as much, yet they need more savings in old age.

The double bind leaves them much more likely to run out of savings before they die. And that’s before the escalating costs of health care are figured in.

Despite all the educational and employment gains women have made over the last three decades, “there’s still a tremendous gender gap” in retirement prospects, says Beth Almeida, executive director of the National Institute on Retirement Security.

The institute has just released an unsettling account of the many ways in which women are financially disadvantaged in our current retirement system — a system that is crumbling for everyone, but with the fallout hitting women hardest. “The retirement glass ceiling,” as the group calls it, was firmly in place before the financial crisis hit. Now it is hardening.

Women are only about half as likely as men to have a traditional defined-benefit pension plan, the type that guarantees monthly payments for life. Even when they do enjoy this type of coverage from their own jobs, their average benefits are lower — by about $5,000 annually. For a woman whose husband is covered by this type of pension, benefits after his death are guaranteed, unless she at some point consented to forgo them.

With 401(k) accounts, women are at triple risk due to their lower earnings, their need for more savings — and their own investing styles, in which they choose conservative investments far more than men do, reducing the income the accounts accrue. The pay-to-pension gap is particularly striking. A woman who earns $50,000 a year would have to put away $1,000 more annually than a man with the same salary, just to stay even with him in retirement, the institute says.

If she then invests that savings balance conservatively, avoiding the risk — and the greater returns — of stocks, for example, she diminishes her retirement income again. Despite the educational attainment and workplace experience that younger women have achieved, it hasn’t made them much more financially astute than their mothers. In fact, even women under 30 are less financially literate than men in their age group, the report says. “It’s consistent among all age groups, and you see it when you look internationally,” Almeida says.

What’s more, women who leave a job and are eligible to take their retirement savings with them are more likely than men to take a lump sum distribution — and use it to pay family expenses such as those for a child’s education, medical and dental costs, and other bills. But this early virtue (or necessity) only disadvantages women again later. An individual who withdraws just $5,000 from a retirement account at age 35 will have lost out on more than $38,000 in retirement savings by age 65, the research shows.

The do-it-yourself retirement system that politicians — and the mutual fund industry — pushed only a few years ago as a chance for middle-income workers to gain financial independence in old age has never been much of a boon. That was true before the financial crisis. Now it’s a bust. “At the end of the day, even the person who did everything right really got whacked,” Almeida says.

For most American women, the outlook is for an old age in which they are financially strained and yet must cope with escalating and unpredictable health care costs. In 2007, twice as many elderly women than men were poor, and women are more likely to fall into poverty as they grow older.

This sure isn’t happy talk for Mother’s Day weekend. But it’s a talk families must have after the celebrations end.

Marie Cocco’s e-mail address is mariecocco(at)washpost.com.

© 2009, Washington Post Writers Group

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.