Mark Zuckerberg Just Lost $2 Billion

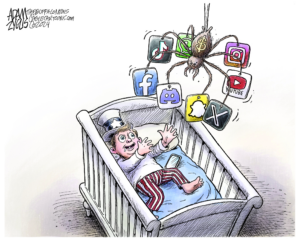

Mark Zuckerberg’s fortune dropped $2 billion Monday as shares of Facebook tumbled to $34.03, 11 percent below their initial public offering price of $38. The loss prompted analysts and buyers to wonder whether the company was overvalued at the $105 billion it gained on the day of its IPO.

Mark Zuckerberg’s fortune dropped $2 billion Monday as shares of Facebook tumbled to $34.03, 11 percent below their initial public offering price of $38. The loss prompted analysts and buyers to wonder whether the company was overvalued at the $105 billion it gained on the day of its IPO.

To put things in perspective, $2 billion was the amount numerous shareholders lost collectively in a bad bet recently made by JPMorgan. –ARK

Your support matters…DealBook at The New York Times:

On Friday, traders at the company’s lead underwriter, Morgan Stanley, resorted to buying shares to prop up the price at $38, an important psychological barrier. To break the offering price would lead to what traders call a “busted I.P.O.,” an embarrassing moment for the underwriters.

… The sell-off is sure to leave analysts and shareholders wondering whether Facebook was worth the enormous $105 billion market capitalization it gained from its initial public offering. Critics have said the company does not generate nearly enough advertising revenue to justify being priced at 108 times earnings over the last 12 months.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.