Large U.S. Firms Hold $2.1 Trillion Overseas to Dodge Taxes

The 500 largest US companies would owe an estimated $620 billion in U taxes were it not for the more than $21 trillion in offshore cash that most of the firms hold in foreign tax havens, according to a study released this week . Wikimedia

Wikimedia

The 500 largest U.S. companies would owe an estimated $620 billion in U.S. taxes were it not for the more than $2.1 trillion in offshore cash that most of the firms hold in foreign tax havens, according to a report released this week.

The study, by Citizens for Tax Justice and the U.S. Public Interest Research Group Education Fund, found that almost three-quarters of the firms on the Fortune 500 list of biggest American companies by gross revenue operate tax haven subsidiaries in countries such as Bermuda, Ireland, Luxembourg and the Netherlands.

To obtain these figures, the study used the companies’ own financial filings with the Securities and Exchange Commission.

Reuters reports:

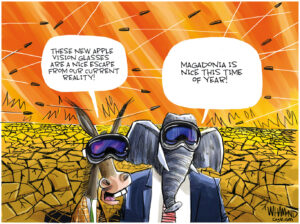

Technology firm Apple was holding $181.1 billion offshore, more than any other U.S. company, and would owe an estimated $59.2 billion in U.S. taxes if it tried to bring the money back to the United States from its three overseas tax havens, the study said.

The conglomerate General Electric has booked $119 billion offshore in 18 tax havens, software firm Microsoft is holding $108.3 billion in five tax haven subsidiaries and drug company Pfizer is holding $74 billion in 151 subsidiaries, the study said.

“At least 358 companies, nearly 72 percent of the Fortune 500, operate subsidiaries in tax haven jurisdictions as of the end of 2014,” the study said. “All told these 358 companies maintain at least 7,622 tax haven subsidiaries.”

Fortune 500 companies hold more than $2.1 trillion in accumulated profits offshore to avoid taxes, with just 30 of the firms accounting for $1.4 trillion of that amount, or 65 percent, the study found.

Fifty-seven of the companies disclosed that they would expect to pay a combined $184.4 billion in additional U.S. taxes if their profits were not held offshore. Their filings indicated they were paying about 6 percent in taxes overseas, compared to a 35 percent U.S. corporate tax rate, it said.

“Congress can and should take strong action to prevent corporations from using offshore tax havens, which in turn would restore basic fairness to the tax system, reduce the deficit and improve the functioning of markets,” the study concluded.

Read more here.

–Posted by Roisin Davis

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.