Labor Lawyer: Look to Keynes to Fix Economy

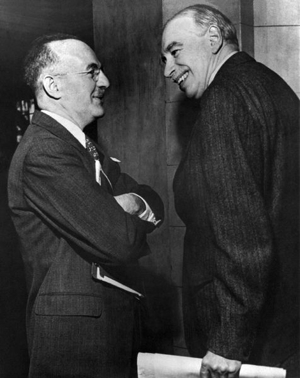

Wall Street’s occupiers are asking the big questions about the U.S. economy. What can we do to create jobs, eliminate poverty and free the nation from the grip of debt? American labor lawyer Thomas Geoghegan points to early 20th-century economist John Maynard Keynes for some clues. (more)

Wall Street’s occupiers are asking the big questions about the U.S. economy. What can we do to create jobs, eliminate poverty and free the nation from the grip of debt? American labor lawyer Thomas Geoghegan points to early 20th-century economist John Maynard Keynes for some clues.

Conservatives scoff at Keynes for suggesting government should spend to raise employment. But as Geoghegan points out, Keynes knew that a stimulus alone was no cure for an economy in crisis. Additionally, to solve a problem like the U.S. trade deficit — which ran up to almost $700 billion over the summer — political leaders might coax a nation’s rich into investing in industries that produce goods for sale abroad.

Keynes’ ideas enjoyed a brief revival on the left during the beginning of the current crisis, but died away quickly after Obama and the Democrats’ milquetoast stimulus failed to fix the economy. Geoghegan argues for a more thorough return to Keynes. Among many proposals, he suggests that Democrats take up the issue of the trade deficit by making the connection between private, public and external debt clear to the American public, a platform he claims Republicans would have a difficult time responding to. –Alexander Reed Kelly

Your support matters…Thomas Geoghegan in The Nation:

So what’s Keynes’s answer? It’s simple. While he believed in public works, to say the least — he practically invented the concept — he never presented the public sector as the real key to the economic problem. Rather, as he writes in The General Theory, “The weakness of the inducement to invest has been at all times the key to the economic problem.”

We have to get the rich to invest. Specifically, we have to get the rich to invest “by employing labor on the construction of durable assets.” We don’t have to get the rich to consume. They will gag. And we don’t really have to get the rich to work. Who cares if they work? They can stay at home in bed in silken sheets.

The real point is to get them to invest — not save, not speculate in financial instruments, but invest in widgets we can wrap and ship and sell abroad. And Keynes would put that question to the left, to us: How can we get the rich to invest?

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.