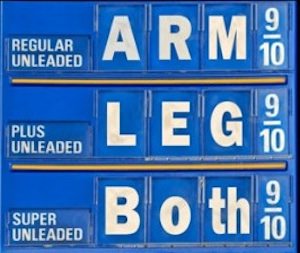

Is Rampant Speculation Driving Up the Price of Oil?

It seems everyone's got a pet theory about why the price of oil has jumped roughly 30 percent since the start of the year Right- wingers blame a conspiracy hatched by President Barack Obama to strangle domestic oil production and push his "radical" green agenda on an unsuspecting America (more).

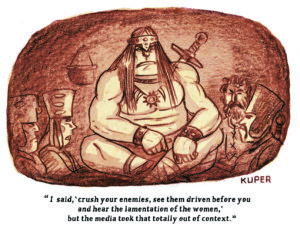

It seems everyone’s got a pet theory about why the price of oil has jumped roughly 30 percent since the start of the year. Right-wingers blame a conspiracy hatched by President Barack Obama to strangle domestic oil production and push his “radical” green agenda on an unsuspecting America. Donald Trump blames OPEC. Oil companies say high oil prices are a result of “market fundamentals,” as in there is too much demand and not enough supply, and the whole situation is outside of their control. Newt Gingrich, who relaunched his 2008 “Drill Here, Drill Now” campaign, backs them up and tries to con people into believing we can fix everything with more offshore drilling.

But the real culprit, it seems, is good old-fashioned, Enron-style manipulation of the oil market by speculators and hoarders. It’s gotten so bad that even Goldman Sachs acknowledged that speculators are at least partially responsible for pushing up the price of crude.

Obama seems to have taken notice. Last week he instructed Attorney General Eric Holder to create a Financial Fraud Enforcement Task Force Working Group that, according to Holder, will be “monitoring the oil and gas markets for any wrongdoing so that consumers can be confident they are not paying higher prices as a result of illegal activity.”

But if you think he’ll lower your gasoline bills, don’t hold your breath. The truth is that ever since Congress deregulated the financial industry in 2000 and created what’s known as the “Enron loophole,” manipulation of oil and energy markets has been nearly impossible to investigate, let alone prosecute or stop. —YL

Your support matters…The Globe and Mail:

Several industry analysts dismissed the enforcement action as politically motivated window dressing designed to demonstrate action in the face of consumer anger over rising pump prices. With prices climbing towards $4 U.S. a gallon south of the border, President Barack Obama is feeling the heat.

“You can almost set your watch on these kinds of things,” Tim Evans, energy analyst with Citi Futures Perspectives, told Reuters news service.

“Every time we see a significant rally in oil prices, people start calling their legislators and encouraging them to launch an investigation. Will they find evidence of manipulation? I have no idea. The vast majority of past investigations have found no evidence of wrongdoing.”

While consumers typically blame oil companies for the price spikes, the government will focus closely on speculative markets, said Michael Greenberger, former director of trading and markets at the Commodity Futures Trading Commission.

Mr. Greenberger said there is strong evidence that excessive – and often illegal – speculation can drive energy markets. He pointed to Enron Corp.’s manipulation of California electricity markets and to Amaranth Advisors LLC activities in controlling large positions in the natural gas market when it went bankrupt in 2006.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.