Inside the Sham Foreclosure Review Process

Companies hired to spot wrongful foreclosures made more than $1 billion in a review process that was ultimately scuttled. Meanwhile, banks prepare to divide a $3.3 billion settlement between nearly 4 million borrowers without identifying who needs the money most.

Companies hired to spot wrongful foreclosures made more than $1 billion in a review process that was ultimately scuttled. Meanwhile, banks prepare to divide a $3.3 billion settlement between nearly 4 million borrowers without identifying who needs the money most.

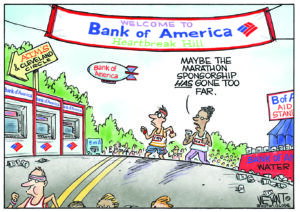

The review was led by the Office of the Comptroller of the Currency and involved 10 major banks, including Bank of America and JPMorgan Chase.

“Because they have no idea how many borrowers were harmed, the regulators are spreading the cash payments over all 3.8 million borrowers — whether there was evidence of harm or not,” The New York Times reported. “As a result, many victims of foreclosure abuses like bungled loan modifications, deficient paperwork, excessive fees and wrongful evictions will most likely get less money.”

Bruce Marks, chief executive of the nonprofit Neighborhood Assistance Corporation of America, told the paper that “It’s absurd that this money will be distributed with such little regard to who was actually harmed.”

Interviews by The New York Times with more than 25 people who reviewed foreclosures, 15 current and former regulators and six bank officials revealed that the process was deeply flawed from the start, in November 2011.

“Several former employees of a consulting firm doing reviews said that their managers showed bias toward the bank that hired them,” the paper reported. “Other reviewers said that the test questions used to evaluate each loan were indecipherable and in some cases the process failed to catch serious harm. Many borrowers said they had never heard of the review or were so baffled by the process that they gave up or dismissed it as just another empty promise.

“A critical flaw from the start was that the federal government farmed out the work of scouring the millions of foreclosures to several consulting firms that charged as much as $250 an hour and outsourced work to contract employees, many of whom had no experience reviewing mortgages, according to the reviewers, regulators and bankers,” the paper added.

Reviewers said oversight by the regulators was virtually nonexistent. Employees hired by one of the consulting companies, Promontory Financial, said the absence of a watchdog enabled some consultants to misrepresent and minimize the number of borrowers found to be harmed. One reviewer said her supervisors “routinely kicked back loans where she had identified harm,” the paper said.

Reviews conducted by other banks were at the least merely inefficient. Some were deliberately exploitative. Deloitte, the consulting firm hired to examine foreclosures for JPMorgan Chase, brought in reviewers to look at documents before the examination standards were “ironed out” and cleared to begin.

“Employees sat around with no work for more than a month while collecting a paycheck,” the paper reported. “ ‘We would just read our books,’ one of the reviewers said.”

Deloitte took issue with such reports. “We strongly disagree with this characterization of the complex independent foreclosure review process and fully stand behind the quality of our work,” a company spokesman said.

Examiners said a single review would take up to 20 hours per file — “more than double the eight hours consultants originally promised regulators,” the paper reported.

Hear a Deloitte CEO talk about his company’s commitment to “leading the profession and setting the standard of audit excellence,” in this promotional video:

— Posted by Alexander Reed Kelly.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.