Here’s Why Americans Need a Basic Income During the Coronavirus Outbreak

Dramatic action is needed now to blunt the immediate pain of vulnerable workers. (Mark Lennihan / AP Photo)

(Mark Lennihan / AP Photo)

As the economic toll of the coronavirus pandemic escalates, support is growing for immediate economic relief for the millions of Americans whose lives have been upended. Utah Senator Mitt Romney has proposed sending a one-time infusion of $1,000 to every American adult during the crisis, while Trump Administration officials are also weighing the idea of direct cash payments to Americans.

While one-time “stimulus checks” are an option— as they were in the immediate aftermath of the 2008 financial crisis—many Americans are going to need longer-term support to weather the coming financial storm. Rather than a single shot of cash, struggling Americans will need an “emergency basic income”—i.e. no-strings-attached, continuing cash support, similar to what former presidential candidate Andrew Yang proposed on the campaign trail.

At the time of his campaign, Yang was pushing for a “universal basic income”– a $1,000 per month entitlement for every American. The idea was expensive, impractical. and rife with the potential for unintended consequences. But now, Yang’s original conception, with some important variations, could save millions of Americans from financial catastrophe. That helps explain why its finding new life from proponents l New York Congresswoman Alexandria Ocasio-Cortez (as well as Yang himself). Yet UBI need not be adopted in its original form to do a lot of good; it need not be as generous as an indefinite entitlement of $1,000 a month, nor does it need to be universal. At least not yet.

Congress should begin with a targeted EBI benefit, aimed especially at lower-wage workers in the financially hemorrhaging hospitality, food service, and entertainment industries. Full-time, hourly workers in these sectors should receive at at least six months of emergency aid—at say, $500 a month.

This targeted relief to the Americans in greatest distress would be more likely to get through Congress quickly, without a detour into the ideological logjams that have plagued the original debate over UBI. Over time, Congress can consider expanding relief for longer periods and to more Americans as the fallout ripples through the economy.

As Americans hunker down in their homes to avoid the risk of contagion, restaurants, bars, hotels, and convention centers have been the first to suffer the fallout. In the Washington, D.C. area, for instance, union official John Boardman told the local ABC affiliate that 75 percent of the region’s hospitality workers are already idled, and that the share of workers on the sidelines could rise to 90 percent within a week.

Taken to a national scale, this means millions of Americans are already out of work. The Bureau of Labor Statistics (BLS) reports that 13.3 million Americans work in food service, including as cooks, bartenders, waitstaff, dishwashers, and other occupations; more than 3 million work as janitors, maids, and housecleaners; and another 500,000 work as ticket takers, ushers, and amusement park attendants. And as Americans stop shopping, getting haircuts, or going to the gym, as more restrictions take hold, that means a heavy financial hit for the 400,000 Americans who work as hairdressers and barbers; the more than 300,000 who work as fitness trainers; and the 4.5 million who work in retail sales.

Few of these workers can afford to go an extended period of time without pay. Food service workers make an average of $25,580 a year, while hairdressers earn an average of $30,190, according to BLS. Maids and house cleaners earn $25,520 on average, while “amusement and recreation attendants” make $23,460. In 2020, the federal poverty line for a family of three is $21,720.

The nonprofit group Prosperity Now finds that more than a third of U.S. households are “liquid asset poor,” meaning they don’t have enough the cash on hand to meet three months of household expenses. Among households of color, who are also disproportionately represented in lower-wage occupations, the liquid poverty rate is as high as 53 percent.

Providing these workers with a stable source of income in the medium-term could help them keep to paying the rent and putting food on the table. It could help stave off the direst hardships of eviction and hunger and help the vulnerable avoid turning to payday lenders, pawnshops, and other predatory financial providers who might be all too eager to profit from this crisis.

EBI would also be more immediate than simply expanding unemployment insurance benefits, as the coronavirus relief package recently passed by the House would do. While the $1 billion for unemployment benefits included in that bill is a vital step, many workers are still likely to miss out if they are temporarily idled. Most state unemployment insurance programs require applicants to prove they are looking for work, a requirement that makes little sense when entire industries have simply evaporated for the time being. Workers also need to be unemployed to be eligible, versus simply furloughed from their jobs. Plus, they must file for new benefits weekly—a bureaucratic detail that makes sense in normal circumstances but is a needless barrier to relief today. And while the proposed relief would provide $500 million in emergency grant aid to states, those states must then show a 10 percent increase in unemployment to be eligible for these dollars—a seemingly high bar that could take some time to reach. In short, these programs and proposals do not meet the demands of an unprecedented pandemic. We will need something more.

The good news is that the Administration’s embrace of direct aid means it might be acknowledging the flaws of the payroll tax cut that President Donald Trump first proposed, which would largely benefit more affluent workers and those who manage to keep their jobs.

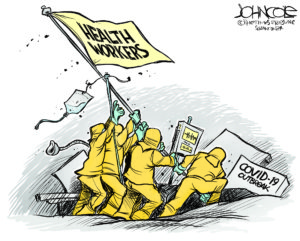

The economic fallout from the coronavirus pandemic will no doubt need long-term, ongoing attention. But we need to take dramatic actions now to blunt the immediate pain of America’s most vulnerable workers.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.