Greek Banks Close Indefinitely After Weekend That Shook the Euro

Greeks found their savings blocked and banks closed Monday morning after a standoff between the country and its bailout creditors that cast doubt on the future of Europe’s single-currency zone. Alpha / CC BY-SA 2.0

Alpha / CC BY-SA 2.0

Greeks found their savings blocked and banks closed Monday morning after a weekend standoff between the country and its bailout creditors that cast doubt on the future of Europe’s single-currency zone.

The Guardian reports:

The Greek government decided on Sunday night it had no option but to close the nation’s banks the following day after the European Central Bank (ECB) raised the stakes by freezing the liquidity lifeline that has kept them afloat during a six-month run on deposits.

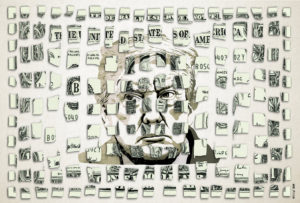

The Athens Stock Exchange will not reopen on Monday either. The dramatic move, after 48 hours of sensational developments in Greece’s long-running battles with creditors, was sparked by the country’s prime minister, Alexis Tsipras’s Friday night call for a referendum on its creditors’ demands. That prompted finance ministers of the eurozone to effectively put an end to his country’s five-year bailout by the International Monetary Fund, the ECB and the European commission.

In a brief, televised address to the nation, Tsipras threw the blame onto the leaders of the eurozone. But he did not say how long the banks would remain shut, nor did he give details of how much individuals and companies would be allowed to withdraw once they reopened. …

[A decree signed by Tsipras and president Prokopis Pavlopoulos] said all banks would be kept shut until after the referendum on 5 July and withdrawals from cash machines would be limited to €60 – about £40. Cash machines are not expected to reopen until later on Monday.

Read more here.

— Posted by Alexander Reed Kelly.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.