Foreclosure Settlement Ends Investigation Into Banks

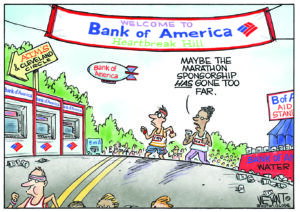

Homeowner advocates and some lawmakers are upset that an $8.5 billion settlement with JPMorgan Chase, Bank of America, Wells Fargo and other banks over improper foreclosures would let lenders off the hook both financially and legally.

Homeowner advocates and some lawmakers are upset that an $8.5 billion settlement with JPMorgan Chase, Bank of America, Wells Fargo and other banks over improper foreclosures would let lenders off the hook both financially and legally.

For one thing, the settlement would end an investigation into how the banks seized and sold the homes of borrowers, often without proper procedure. Furthermore, the amount of money, according to at least one advocate quoted by the AP, is less than the banks expected to spend.

The Associated Press via Google:

Diane Thompson, a lawyer with the National Consumer Law Center, complained that the deal won’t actually compensate homeowners for the actual harm they suffered.

The deal “caps (banks’) liability at a total number that’s less than they thought they were going to pay going in,” she said.

Most of the money will go to homeowners whose houses were seized and sold at a loss. Americans who were more or less rolled by the failed mortgage renegotiation process will get much lesser compensation.

— Posted by Peter Z. Scheer. Follow him on Twitter: @peesch.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.