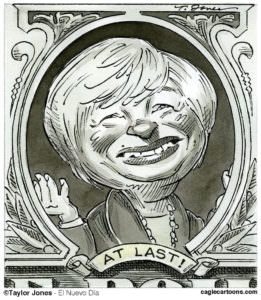

Fed to Keep a Lid on Rates Through 2014

The Federal Reserve lent weight to economists’ warnings of a long and slow recovery on Wednesday when it announced plans to keep short-term interest rates near zero for at least the next three years. The idea is that low rates will encourage borrowing and investment in American businesses, helping resurrect the economy.

The Federal Reserve lent weight to economists’ warnings of a long and slow recovery on Wednesday when it announced plans to keep short-term interest rates near zero for at least the next three years. The idea is that low rates will encourage borrowing and investment in American businesses, helping resurrect the economy. –ARK

Your support matters…The New York Times:

The decision means that the Fed does not expect the economy to complete its recovery from the 2008 crisis over the next three years. By holding rates near zero, the Fed hopes to hasten that process somewhat by reducing the cost of borrowing.

“While indicators point to some further improvement in overall labor market conditions, the unemployment rate remains elevated,” the Fed said in a statement released after a two-day meeting of its policy-making committee. “Household spending has continued to advance, but growth in business fixed investment has slowed, and the housing sector remains depressed.”

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.