Fed Looking Into Goldman Sachs’ Role in Greek Debt Crisis

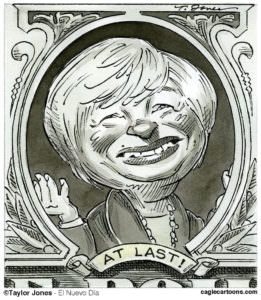

It's not the only financial institution involved, but Goldman Sachs features prominently among the companies that the Federal Reserve is investigating in relation to Greece's recent debt calamity, Fed chief Ben Bernanke told the Senate Banking Committee on Thursday.

It’s not the only financial institution involved, but Goldman Sachs features prominently among the companies that the Federal Reserve is investigating in relation to Greece’s recent debt calamity, Fed chief Ben Bernanke told the Senate Banking Committee on Thursday.

For more on Goldman and Greece, check out this recent column by Truthdig’s Robert Scheer.

Your support matters…MarketWatch:

“We are looking into a number of questions related to Goldman Sachs and other companies and their derivatives arrangements with Greece,” Bernanke said in testimony before the Senate Banking Committee.

The European Union has demanded that the Greek government provide details of how it used currency swaps and other instruments.

Greece in 2001 borrowed billions, with the aid of Goldman Sachs […] in a deal hidden from public view because it was treated as a currency trade rather than a loan.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.