Elizabeth Warren Grills Fed Chairman Over ‘Too Big to Fail’ Banks

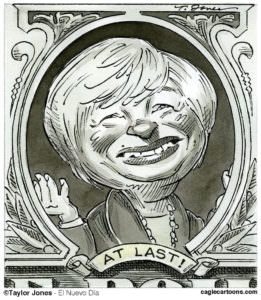

Sen. Elizabeth Warren, D-Mass., a two-time Truthdigger of the Week, demonstrated once again why big banks and Wall Street want to keep their distance from her when she took on Ben Bernanke during his semiannual appearance before the Senate Banking Committee on Tuesday.

Sen. Elizabeth Warren, D-Mass., a two-time Truthdigger of the Week, demonstrated once again why big banks and Wall Street want to keep their distance from her when she took on Ben Bernanke during his semiannual appearance before the Senate Banking Committee on Tuesday. Less than two weeks after interrogating and shaming government regulators for not prosecuting the financial institutions that played cruical roles in the economic meltdown, the freshman senator went after the chairman of the Federal Reserve over government policies that allowed the largest banks in the U.S. to become “too big to fail.”

The Huffington Post:

Though Bernanke questioned the accuracy of the $83 billion figure, he admitted that big banks get some subsidy. But he said the market was wrong to give banks any subsidy at all (in the form of lower borrowing costs), insisting that the government will in fact let banks fail. The 2010 Dodd-Frank financial reform law has given policymakers the tools to safely shut down big, failing banks, he claimed.

But when repeatedly pressed by Warren, Bernanke’s confidence seemed to waver.

…Warren also pointed out that big banks are probably loath to give up any market subsidy — $83 billion or otherwise.

“Big banks are getting a terrific break, and little banks are just getting smashed,” Warren said.

“I agree with you 100 percent,” Bernanke said.

— Posted by Tracy Bloom.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.