Economic Decline May Have Slowed

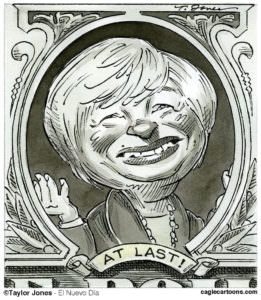

Fed Chairman Ben Bernanke presented a report Tuesday about the U.S. economy's health. On the "bright side," the economy appears to be declining at a slower rate than before, but home prices are still falling, credit is still very tight and, oh yeah, job losses are still rising. As a result of all the good news, the Fed intends to maintain "exceptionally low" interest rates for a while longer.

Fed Chairman Ben Bernanke presented a report Tuesday on the U.S. economy’s health before the House Financial Services Committee. On the “bright side,” the economy appears to be declining at a slower rate than before, but home prices are still falling, credit is still very tight and, oh yeah, job losses are still rising. As a result of all the good news, the Fed intends to maintain “exceptionally low” interest rates for a while longer.

Your support matters…The New York Times:

The pace of economic decline appears to have slowed, but the labor market remains weak and, in response, the Federal Reserve is likely to maintain interest rates at “exceptionally low levels for extended periods,” Ben S. Bernanke, the Fed’s chairman, told lawmakers on Tuesday.

Testifying before the House Committee on Financial Services, Mr. Bernanke said in his comments that despite positive signs of an improvement in the American economy, “the job loss rate remains high and the unemployment rate continues its steep rise.”

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.