David Cay Johnston: Social Security Is Not Going Broke

"Which federal program took in more than it spent last year, added $95 billion to its surplus and lifted 20 million Americans of all ages out of poverty?" finance columnist David Cay Johnston asks.

“Which federal program took in more than it spent last year, added $95 billion to its surplus and lifted 20 million Americans of all ages out of poverty?” finance columnist David Cay Johnston asks.

The answer? Social Security, which ended 2011 with a $2.7 trillion surplus–almost twice what was collected in personal and corporate income taxes during the same year and is expected to go on growing until 2021. Still, some claim that the program is “going broke” and must be privatized to be sustained.

Johnston disputes the claim that Social Security can’t sustain itself already and argues that its surpluses have been used to subsidize tax cuts for the rich. –ARK

Your support matters…David Cay Johnston at Reuters:

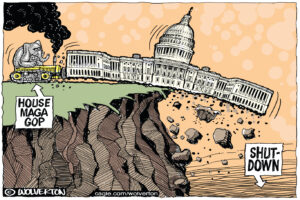

Let’s look at how Social Security taxes have grown in the last half century — a little-known tale of tax burdens shifted off the rich and onto workers. From 1961 through 2011, the year covered in the last Social Security report, Social Security taxes exploded from 3.1 percent of Gross Domestic Product to 5.5 percent.

Income taxes went the other way. The personal income tax slipped from 7.8 percent of the economy to 7.3 percent, with most of the decline enjoyed by people in the top 1 percent of incomes. The big drop was in the corporate income tax, which fell from 4 percent of the economy to 1.2 percent. Notice that the corporate income tax fell by 2.8 percentage points, an amount almost entirely offset by a 2.4 percentage point increase in Social Security taxes.

The effect has been to ease the taxes of the wealthy, while burdening the vast majority of workers. Considering how highly ownership of stocks is concentrated, the benefit of those lower corporate taxes went overwhelmingly to the top 1 percent and, especially, the top 1 percent of the top 1 percent. Considering that the Social Security tax is capped, most of the burden of the increased payroll tax went to the bottom 90 percent.

Now let’s look at how that $2.7 trillion Social Security surplus arose. In 1983, President Ronald Reagan sponsored an increase in Social Security taxes, changing the program from pay-as-you-go to collecting much more taxes than it paid in benefits. The idea was to have the Boomers prepay part of their old age benefits. The extra tax was supposed to pay off the federal debt and then be invested in federal bonds. Instead, Reagan ran huge deficits, violating his 1980 promise to balance the federal budget within three years of taking office.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.