Corporate Citizenship a Dying Concept

The conviction is new that the exclusive purpose of the business corporation is to profit its professional managers and stockholders.

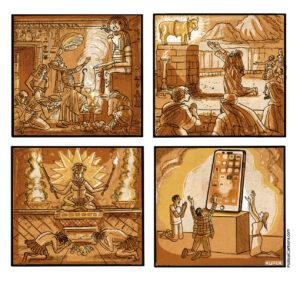

One of the interesting questions that resulted from the Supreme Court decision in the Citizens United case in 2010, which assigned political personhood to corporations, is whether this corporate personhood carries responsibilities. It used to, in another age, but does it now?

The notion of the business corporation as a person was in the past a legal fiction useful in the formation of business enterprises but never before was thought to confer political rights and protections equivalent to those of human beings, as the Supreme Court has held, thereby turning American business into an unprecedentedly powerful political actor and unchecked financial contributor to electoral politics.

Certain responsibilities of “corporate citizenhood” were commonly spoken of in the past, between the Progressive Era (notably the Theodore Roosevelt presidency) and the events preceding the present global recession. Corporate responsibility was a major consideration following the Second World War period of national unity, until America’s seeming triumphal exit from the Cold War and the increasingly frenzied performance of Wall Street underwrote a second Gilded Age of false values, comparable to the original one (between the Ulysses Grant and Theodore Roosevelt presidencies) in its celebration of rampant greed and speculative finance.

The “Remapping Debate” organization in June published the results of an inquiry among 80 American multinational corporations. The question asked was whether as corporations they possessed citizen-like obligations to the American nation. Most refused to answer.

Remapping Debate’s Mike Alberti reported that “among the corporate representatives who did comment, most were unwilling to say that their corporation had any obligations to the United States, let alone to define any such obligations with specificity. Moreover, representatives of some American multinationals said that their companies do not even identify themselves as being American in any sense except that they are legally incorporated and physically headquartered in one of the states of the U.S.”

This response clearly is heavily influenced by the fear that overt identification with the United States risks tax complications for American business organizations whose present and largely successful concentration on avoidance of tax payments anywhere is a large if not the largest contribution to net reported corporate profits today, and thus to the remuneration plus bonuses of corporate management.

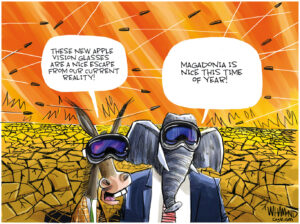

An Apple executive told the New York Times in 2012, “We don’t have an obligation to solve American problems. Our only obligation is to make the best product possible,” from the sale of which Apple has accumulated more than $100 billion held untaxed outside the United States. The company borrows from banks to pay dividends demanded by stockholders rather than import its profits to pay, which would subject it to tax in the U.S. It’s cheaper to borrow and hoard the lucre abroad.

The conviction is new that the exclusive purpose of the business corporation is to profit its professional managers and stockholders (in recent years the American corporation has usually been controlled all but entirely by hired managers rather than by its founders or original owners). Its current owners, or rather its stockholders, are usually an amorphous body of fractional investors incapable of seriously influencing, much less dominating, a board of directors nominated by company executives and beholden to current management. Both stockholders and managers tend to be far more interested in private enrichment rather than in the character, corporate interests and future of the company.

Ralph Gomory, a professor of management at New York University, says that “the idea that a corporation exists solely to make money is actually quite new. … Even in the early 1980s you would be more likely to hear a chief executive officer talking about his responsibilities to the country or to his employees than to his duty to the shareholders.”

William Lazonick, a professor of economics at the University of Massachusetts in Lowell, is quoted as saying, “CEOs were extremely reluctant to shut down factories and lay off a large number of workers … seen as a serious abnegation of corporate responsibility. It was understood that the company had a responsibility to its workers, and that if it failed, society at large would be on the hook for that failure.”

This Remapping Debate paper also quotes Margaret Blair, a professor of law at Vanderbilt, as saying that executives formerly believed strongly in the connection between corporate business and the nation, and “saw the corporate sector as one of the major forces that was working in the best interests of the country. … It was not corporations versus the government. It was much more about everybody being in it together.”

Part of the reason for the dramatic change that has taken place in American business opinion obviously is globalization of business and production. A second is the onset of globalization-induced opportunities for tax minimization or sheer tax evasion. A third, as I have noted before, is the shift of corporate control from owners, now frequently powerless, even collectively, to opportunistic professional management.

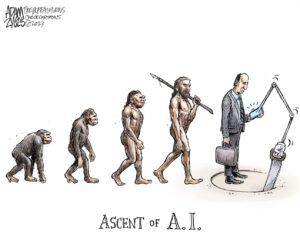

The most important reason, however — in my opinion — has been the profound change that has taken place in economic ideology. Both monetarism and market theory remove from economic management voluntarism, political intelligence and moral responsibility, by describing economic function as objective and automatic. Thus the customer always makes the most advantageous choice, so the market presents a perfect and efficient mechanism dictating the choices that must be made by businesses, while always tending towards perfect competition. Labor is a mere commodity, and unions and wage demands obstacles to the free function of markets. Governments by nature are obstacles to economic freedom.

The labor market will always seek full employment, which always tends to produce inflation and reduce the value of money. The overall market always seeks equilibrium. It is a machine and, when you know how, you need merely to pull the right levers. Or such is the theory.

Visit William Pfaff’s website for more on his latest book, “The Irony of Manifest Destiny: The Tragedy of America’s Foreign Policy” (Walker & Co., $25), at www.williampfaff.com.

© 2013 Tribune Media Services, Inc.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.