Big Finance Argues Its Irrelevance

Don't mistake the claims of relative unimportance coming from the big shots on Wall Street before an audience of federal regulators over the past several months for some sort of newfound humility. (more)

Don’t mistake the claims of relative unimportance coming from the big shots on Wall Street before an audience of federal regulators over the past several months for some sort of newfound humility.

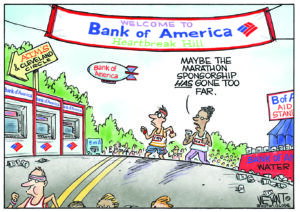

As regulators put together a package of new rules that aims to prevent a repeat of the recent financial meltdown, major commercial lenders, investors and insurers are looking to avoid being branded “systemically important” to the economy, as big banks like Goldman Sachs and Bank of America inevitably will be. The evasive rhetorical maneuvers are intended to avoid government requirements that the firms argue would reduce their profits. — ARK

Your support matters…The New York Times:

… Over the last several months, executives from more than two dozen financial companies and their trade groups have paraded into the Treasury Department, the Federal Reserve and other government agencies to try to persuade top regulators that they are not large or risky enough to threaten the financial system if they should ever collapse.

Big insurers like the Mass Mutual Financial Group and Zurich Financial Services; hedge funds like Citadel and Paulson & Company; and mutual-fund companies like BlackRock, Fidelity Investments and Pacific Investment Management Company have all been making the rounds, according to documents filed by the regulatory agencies.

What they are all hoping to avoid is being designated “systemically important” by a council of financial regulators. That would require them to face stricter federal oversight and keep more cash on hand, which they fear would erode profits.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.