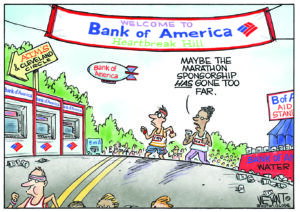

Big Banks Have Found Another Way to Rip You Off

Meet the major banks' newest partner: payday lenders, the owners of those check cashing stores that offer short-term loans with interest rates that sometimes exceed 500 percent.

Meet the major banks’ newest partner: payday lenders! These are the owners of those check cashing stores that offer short-term loans with interest rates that sometimes exceed 500 percent.

The payday loan industry typically preys on the poor and ends up costing Americans billions each year. More and more, the practice is either being outlawed–it’s illegal in 15 states–or subject to heavy regulations.

But that’s not stopping the predatory lenders; they’ve just shifted their loan operations offshore and online.

Now big banks such as JPMorgan Chase, Wells Fargo and Bank of America are getting a piece of that lucrative financial action, helping to ensure that predatory payday lenders get their money–even in states where the making of such loans is illegal. The banks don’t actually fund the loans, but serve as a critical intermediary between the lender and the customer. When a borrower can’t repay a loan, the bank gives the lender access to the customer’s account to withdraw the money owed. And, because the payment amount often exceeds the person’s account balance, the bank gets a nice payday in the form of overdraft fees.

The partnership, needless to say, has been very beneficial to the banks. Whom it’s not beneficial for: anyone who goes through a payday lender to get a short-term loan. Once again, Main Street gets screwed.

Gawker:

Offering quick approval with no credit checks, the lenders lead borrowers into an almost endless runaround while the big banks siphon their savings, and, in the case of one borrower interviewed by the Times, begin to take away child support income. Because they are based offshore, the lenders aren’t beholden to the laws of the borrower’s state.

On top of that, the large banks involved have denied some requests for borrowers to stop the withdrawals from their accounts, even though federal law protects that request. Consumer advocates are focusing on the role of the banks in order to stop the predatory practices of the payday lenders, however the Online Lenders Alliance, the lobbyist organization for the lenders, are promoting proposed legislation that would grant them a federal charter.

Big banks must rely on these types of scams to just barely stay afloat because as the Bloomberg editorial staff pointed out earlier this week, they’re basically broke without huge taxpayer subsidies.

— Posted by Tracy Bloom.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.