Banks Push to Appease Regulators With Low-Ball Damage Compensation

Investigators at the United States Trustee Program, which oversees U.S. bankruptcy cases, are collecting mountains of evidence that show that banks industrywide are hurrying huge numbers of borrowers out of their homes prematurely, based on false loan repayment claims. (more)

Investigators at the United States Trustee Program, which oversees U.S. bankruptcy cases, are collecting mountains of evidence that show that banks industrywide are hurrying huge numbers of borrowers out of their homes prematurely, based on false loan repayment claims.

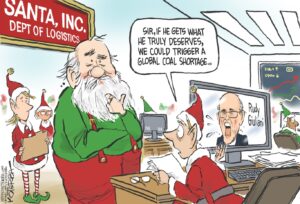

The false claims made by lending banks, which include Bank of America, Citigroup, GMAC, JPMorgan Chase and Wells Fargo, rarely favor borrowers. The $5 billion mentioned below, which lending institutions have offered in order to settle allegations of shady practices, probably represents just a fraction of the total damages incurred. Consequently, banks are fighting to thwart and delay trustee investigations by offering data on a case-by-case basis that they can tailor to hide abuses inherent in overall policies and procedures.

Such broad knowledge would probably give prosecutors the evidence needed to make more damning indictments of the kind that led last week to the conviction of hedge fund manager Raj Rajaratnam. –ARK

Your support matters…The New York Times:

As the Rajaratnam verdict captivated many on Wall Street last week, the institutions that service about two-thirds of the mortgages in this country offered to pay $5 billion to settle allegations about robo-signing and other shady practices that quick-step troubled borrowers out of their homes.

… Because evidence of extensive and abusive servicing practices does in fact exist. It is piling up at the offices of the United States Trustee Program, the arm of the Justice Department that monitors the bankruptcy system. Over the past six months, the trustee has drawn material from 95 field offices covering 88 judicial districts. The findings should dispel any notion that toxic servicing practices were atypical or have done no harm.

… Mistakes happen, of course. And loan servicers like to contend that if errors occur, they are rare and honestly made. But after sifting through the data produced by this investigation, Mr. White disagreed that problems are rare. “In Senate testimony, an executive from Countrywide said its error rate was 1 percent,” Mr. White recalled. “The mortgage servicer industry error rate might be 10 times higher, based on the number of cases we are looking at.”

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.