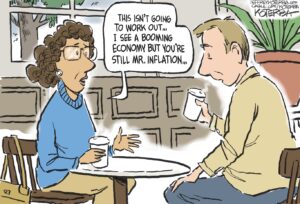

Banks Gamble With Almost-Free Money

The Fed has been lending money at record-low rates, but instead of passing on the cash to businesses and consumers, big banks are rolling the dice in the financial markets China and Japan have warned that these American high jinks could once again upend (continued).

The Fed has been lending money at record-low rates, but instead of passing on the cash to businesses and consumers, big banks are rolling the dice in the financial markets. China and Japan have warned that these American high jinks could once again upend the global economy.

The Federal Reserve Board is aware of the problem, as minutes from its latest meeting show. But, at this time, the Fed doesn’t consider the risk dangerous enough to take action. — PZS

Your support matters…Bloomberg via Eschaton:

Financial officials in Japan and China, Asia’s two largest economies, said last week that the Fed’s interest-rate policy risks spurring speculative capital that may inflate asset prices and derail the global economic recovery.

“Participants noted that the recent fall in the foreign exchange value of the dollar had been orderly and appeared to reflect an unwinding of safe-haven demand in light of the recovery in financial market conditions this year,” the minutes said. “Any tendency for dollar depreciation to intensify or to put significant upward pressure on inflation would bear close watching.”

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.