Bailout Time for Fannie and Freddie

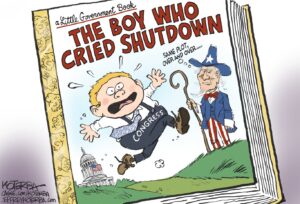

Congress to the rescue! Mortgage lending giants Fannie Mae and Freddie Mac are being propped up in their time of dire need, thanks to a bill passed Saturday that will lift the world's two largest financial institutions out of immediate danger and help some homeowners handle mortgage crises.

Congress to the rescue! Mortgage lending giants Fannie Mae and Freddie Mac are being propped up in their time of dire need, thanks to a bill passed Saturday that will lift the world’s two largest financial institutions out of immediate danger and help some homeowners handle mortgage crises.

Your support matters…The Telegraph:

World markets are poised for a major relief rally today [Monday] after the US Congress met in a rare weekend session to pass the most far-reaching rescue package for America’s financial system since Franklin Roosevelt’s New Deal.

The emergency bail-out gives the US Treasury sweeping authority to inject capital into the giant mortgage lenders Fannie Mae and Freddie Mac, which together own or guarantee half the country’s $12 trillion stock of home loans.

The ceiling on the US national debt has been lifted by a further $800bn, giving the Treasury almost unlimited resources to prop up the two lenders.

In parallel, the Federal Housing Authority (FHA) is to guarantee up to $300bn of fresh mortgages for struggling homeowners trapped with soaring loan costs, often the result of “honeytrap” contracts.

The scheme aims to avoid an avalanche of fresh defaults as the housing market continues to deteriorate. Over 740,000 homes fell into foreclosure in the second quarter.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.