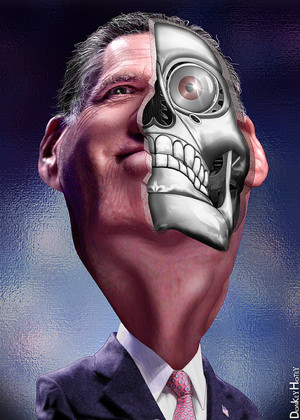

‘Art-History Majors’ Are Wrecking America, Lead Romney Donor Says

That’s right. Nothing to do with self-serving politicians or predatory bankers. And while we’re at it, inequality’s a good thing. Those are the arguments printed in former Bain Capital executive Edward Conard's upcoming “Unintended Consequences,” a free-market apologia that New York Times reporter Adam Davidson dubbed likely to be the “most hated book of the year.”

That’s right. Nothing to do with self-serving politicians or predatory bankers. And while we’re at it, inequality’s a good thing. Those are the arguments printed in former Bain Capital executive Edward Conard’s upcoming “Unintended Consequences,” a free-market apologia that New York Times reporter Adam Davidson dubbed likely to be the “most hated book of the year.”

Conard’s an aggressive, supremely wealthy philistine with little respect for full empirical analysis, especially if it pertains to economics. He has either ignored or knows nothing about this research featured on “NOVA” in 2010. He approaches love as you might gambling, trumping up a dubious dating algorithm designed to find him the “best” wife. He treats leisure as a sin and beauty a distraction to be eliminated by the possibility of the highest possible monetary rewards.

Just read this bit from Davidson, who spoke with Conard over many meetings:

The world Conard describes too often feels grim and soulless, one in which art and romance and the nonremunerative satisfactions of a simpler life are invisible. And that, I realized, really is Conard’s world. “God didn’t create the universe so that talented people would be happy,” he said. “It’s not beautiful. It’s hard work. It’s responsibility and deadlines, working till 11 o’clock at night when you want to watch your baby and be with your wife. It’s not serenity and beauty.”

As for the task of motivating people who don’t want to become CEOs or investors to get out of the museum and into the office, “It’s simple economics,” Conard asserts. “If the payoff for risk taking is better, people will take more risks.” Humanity is a monolith, therefore, in which all persons may be moved to become high-rolling bankers if only enough money is dangled before them. Artists, professors and even lawyers be damned. –Alexander Reed Kelly

Your support matters…The New York Times:

Nearly every economist I spoke with said that Conard has too much faith in the market’s ability to reward only those who create real value. Conard, for instance, insists that even the dodgiest financial products must have been beneficial or else nobody would have bought them in the first place. If a Wall Street trader or a corporate chief executive is filthy rich, Conard says that the merciless process of economic selection has assured that they have somehow benefited society. Even pro-market Romney supporters take issue with this. “Ed ought to be more concerned about crony capitalism,” Hubbard told me.

“Unintended Consequences” ignores some of the most important economic work of the past few decades, about how power and politics influence economic growth. In technical language, this field is the study of “rent seeking,” in which people or companies get rich because of their power, not because of their ideas. This is one of the few fields in economics in which left and right share many influences and ideas — namely that wealthy individuals and corporations are able to influence politicians and regulators to make seemingly insignificant changes to regulations that benefit themselves. In other words, to rig the game. One classic example is banking. Banks have enormous resources to constantly put explicit or subtle pressure on lawmakers and regulators so that regulation can eventually serve their interests.

Conard’s version of the financial crisis ignores much reporting and analysis — including work I’ve done with NPR’s “Planet Money” team — that shows that some of the nation’s largest banks actively manipulated customers and regulators and, sometimes, their own stockholders to profit from dangerous risk. And for many economists, rising inequality can create exactly the wrong outcomes for society over all. Rather than simply serving as an invitation for everybody to engage in potentially beneficial risk-taking, inequality can allow those with wealth to crush new ideas.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.