Arctic Oil and Gas Will Exact High Price

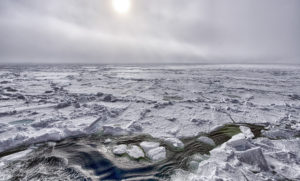

As ice melts in the Arctic, there are conflicting views on whether exploiting new oil and gas reserves will be commercially viable. The future of this pristine environment may depend more on the price of fuel than anything else.

By Paul Brown, Climate News NetworkThis piece first appeared at Climate News Network.

LONDON — First, there’s a new assessment report by Ernst & Young, the international accountancy firm. It says the high-cost, high-risk resources of oil and gas available inside the Arctic Circle are both commercially exploitable and affordable.

After analysis of the tax and incentive schemes offered by the eight countries with hopes of drilling oil and gas wells in the Arctic, the firm concludes that Russia is a good investment opportunity with massive Arctic gas reserves.

However Alaska is the best bet for oil, with the largest untapped Arctic reserves. Norway, because of the stability of its government, and the opening up of Greenland for exploration also present good business opportunities.

This assessment contrasts with an influential American view – that international gas prices will fall because of an energy glut, making Russian gas too expensive to sell.

The US Council on Foreign Relations says that countries in Europe, currently dependent on high-priced Russian gas, will be able to exploit cheap shale gas within their own borders. Some will no longer need to import Russian gas at all.

The Ernst and Young report argues that with 20% of the planet’s remaining oil and gas reserves lying in the Arctic, and still to be located and exploited, the potential is enormous.

Already 61 large oil and natural gas fields have been discovered within the Arctic Circle – 43 are in Russia, 11 in Canada, six in Alaska and one in Norway.

Expensive and uncertain

However, the report warns: “The quest for Arctic oil and gas resources is not for the faint of heart nor for those with less-than-deep pockets. Rather, Arctic resource development is both high-cost and high-risk.”

It says that apart from the harsh climate other challenges are lack of infrastructure, pipelines and ports. Special tankers and icebreakers will be needed, and if there are spills they will be difficult to control and clear up.

There are overlapping sovereignty claims, which lead to uncertainty about the environmental rules in any particular area. The firm also says that environmental campaigners wishing the Arctic to be left alone can be troublesome.

Although the report is generally positive about exploiting the Arctic it does emphasise the long lead times of projects and says only the five or six largest oil and gas companies with the deepest pockets will be able to afford the investment.

“These operations are clearly on the outer limits of both safety and commercial viability for the industry”, it says, “and a spill or accident there would be catastrophic. The economics of Arctic development are also looking forward to even higher oil prices which may or may not happen in the near term.”

Prohibitive production costs

Ernst and Young’s cautious but optimistic approach to the prospects of investment in the Arctic contrasts with the Council on Foreign Relations’ assessment of future energy supplies, particularly the Russian prospects.

While it accepts that Russia has vast gas reserves, the expense of extracting and transporting the gas from the far north will make it uncompetitive in world markets, the Council says.

Aviezer Tucker, writing on the website of Foreign Affairs, published by the Council, says the energy map of the world is being redrawn, and the fall in gas prices in America as a result of vast new discoveries of shale gas is about to be repeated in Europe.

Ukraine and Poland are among the countries currently dependent on Russian gas which have the potential to produce all their own supplies of much cheaper shale gas. If they did, the effect would be an energy glut and falling gas prices severely damaging the Russian economy.

Tucker quotes some estimates that 60% of Russian federal income comes from energy exports. Russia’s other potential market for gas, China, is also discovering that it too has large shale gas reserves.

If this assessment is right, then much of the Arctic gas will stay beneath the Earth’s crust, just too expensive to exploit.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.