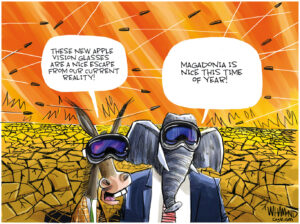

Apple Walks Away From Multibillion Dollar Tax Obligation

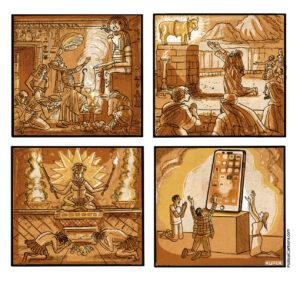

Apple will deprive the American public of $9 billion in U.S. taxes by paying shareholders with proceeds from a $17 billion blockbuster bond sale instead of using money it made abroad.

Apple will deprive the American public of $9 billion in U.S. taxes by paying shareholders with proceeds from a $17 billion blockbuster bond sale instead of using money it made abroad.

The company has $100 billion of offshore cash compared with $45 billion held within the country. Any cash brought within national borders from abroad would be subject to a 35 percent tax rate, lawyers and accountants say.

The tariff would have been incurred by a record-breaking return of $55 billion to its investors.

— Posted by Alexander Reed Kelly.

Your support matters…Financial Times:

The company will also save around $100m a year from using the debt rather than straight cash. Although the company’s $17bn borrowing from the corporate bond market this week will cost it around $310m a year in interest payments, it will regain about a third of that due to tax deductions.

“There is a huge tax saving for Apple in borrowing the money rather than bringing it back to the US,” said Kevin Phillips, international tax partner at Baker Tilly. “The company will keep getting that $100m or so tax credit every single year.”

Gerald Granovsky, an analyst at Moody’s, said: “If you assume the statutory 35 per cent corporate tax rate, based on the data available and on a back of the envelope calculation, to generate in the US the equivalent of $17bn the company would need to repatriate $26bn.

“That is less attractive than paying the $300m in interest attached to this bond sale,” he added.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.