And Now, Even More Bad Financial News

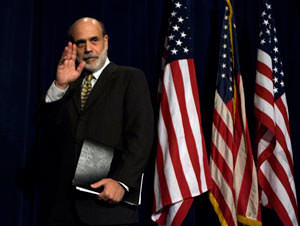

There will hopefully come a day when the news from Wall Street is actually good (at the moment, anything better than utterly terrifying news would be nice), but Tuesday was not that day, despite Federal Reserve Chairman Ben Bernanke's intimations that help could soon be on the way.

There will hopefully come a day when the news from Wall Street is actually good (at the moment, anything better than utterly terrifying news would be nice), but Tuesday was not that day, despite Federal Reserve Chairman Ben Bernanke’s intimations that help could soon be on the way.

Your support matters…The New York Times:

Stocks plunged on Tuesday afternoon — shedding 200 points in the final hour of trading alone — despite reassurances from the chairman of the Federal Reserve, Ben S. Bernanke, that the central bank was prepared to lower interest rates, words that many investors had said they were waiting to hear.

“You are getting all the things that you would think the equity markets would respond very favorably to,” Steve Sachs, director of trading at Rydex Investments, said. “But at this point it just doesn’t seem to be doing it. It’s the attitude of “Sell” — regardless of what the news is.”

The Dow Jones industrial average, which had lumbered downward from early in the session, accelerated its losses in the final hour and ended down 508.39 points, breaking below the 9,500 mark to close at 9,447.11.

The broader Standard & Poor’s 500-stock index fell by 5.7 percent, ending below 1,000 for the first time in five years.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.