A Welcome ‘Shareholder Democracy’

This movement could be more critical than even presidential elections. One example: ExxonMobil stock owners could generate major steps in the area of renewable and alternative energy.The never-ending presidential campaign is enough to overload anyone’s senses. The themes and messages are mind-numbingly discombobulated — race, class, flag lapel pins, NAFTA, bowling photo ops, Iraq and, of course, endless promises of “real change.” It is like the head-pounding noise of bad heavy metal music, but the subliminal message isn’t a satanic code — it’s one telling us that presidential campaigns are always the most important arenas of democracy.

But this week you may hear another sound. This one will come from ExxonMobil’s annual meeting in Dallas. The thrum may be quieter than the political din, but it is about something that can be more critical than even presidential elections — something called shareholder democracy.

The concept is simple: By law, anyone owning at least $2,000 of company stock may file a shareholder resolution demanding a change in that company’s behavior. Investors then get to vote their shares of stock on the resolution.

At ExxonMobil’s meeting on May 28, a group of shareholders is planning to offer resolutions asking the company to invest more in renewable and alternative energy. Though the move has garnered scant media attention, it could be far more significant than the presidential pandemonium. According to Friends of the Earth, ExxonMobil and its predecessors’ products are responsible for emitting roughly 5 percent of all human-generated carbon pollution since 1882. Forcing a company like this to even minimally change could have planetwide effects.

But, then, with the company generating $40 billion in annual profits, ExxonMobil’s shareholders are making bank. So why would any of them vote to change the business? Because if they don’t, those profits could evaporate.

ExxonMobil is one of the globe’s least diversified energy companies. The vast majority of its resources go toward developing air-polluting fossil fuels, and it invests almost nothing in renewable or alternative energy. That currently means big money, but if oil supplies diminish, governments regulate carbon or fossil fuel prices fluctuate, it could mean even bigger losses. And so those shareholders demanding change are appealing to fellow investors’ belief in capitalism, not altruism.

For example, citing their desire to “safeguard long-term shareholder value,” a group of shareholders with $5 billion in ExxonMobil stock excoriated company management in 2006 for “not sufficiently preparing for tomorrow’s energy” and running “the risk of lagging significantly behind” competitors. Many of these investors are expected to back this year’s alternative energy resolution, especially considering the boost from none other than the Rockefellers — the family that originally founded what would become ExxonMobil.

The name Rockefeller has long been associated with pollution-belching smelters and landscape-scarring mines, but also with steady profits. It is that business sense — not tree-hugger idealism — that led a group of Rockefellers this month to embrace the environmental initiative. “If the next 20 years of the energy business were going to be just about oil and gas, we wouldn’t be holding this press conference,” said one Rockefeller kin at the event announcing the family’s position.

ExxonMobil management could win out and defeat the resolution, but it would be a Pyrrhic victory. Executives would keep generating publicity that not only makes the company look bad but reminds the public about the untapped power of shareholder democracy that big business would rather people ignore.

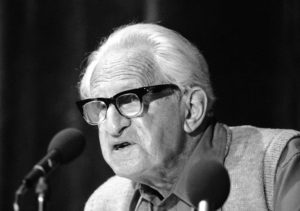

After all, through pension funds and 401(k) plans, ordinary Americans collectively own a lot of stock, and consequently a big chunk of shareholder resolution votes. These votes often go unexercised, but the more attention shareholder resolutions receive, the more citizens will “become educated about various corporation policies” because they will realize “they can do something about them,” as famed shareholder activist Saul Alinsky once said. That is what truly scares Corporate America — and what could bring the most “real change” of all.

Note: David Sirota’s upcoming book, “The Uprising,” includes a chapter on shareholder activists’ long-running battle with ExxonMobil. The book will be released on May 27.

Sirota is a fellow at the Campaign for America’s Future and a board member of the Progressive States Network, both nonpartisan organizations. His blog is at www.credoaction.com/sirota.

© 2008 Creators Syndicate Inc.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.