A Solution to the Problem of Corporate Money Hoarding

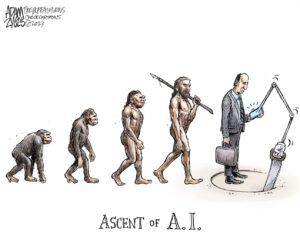

At the core of the non-recovery in America's economic crisis is the stockpiling of enormous sums of untaxed cash -- totaling almost $1.5 trillion at the end of last year -- by corporations that refuse to invest in new businesses and projects that would serve the public good.

At the core of the non-recovery in America’s economic crisis is the stockpiling of enormous sums of untaxed cash — totaling almost $1.5 trillion at the end of last year — by corporations that refuse to invest in new businesses and projects that would serve the public good, Alejandro Reuss, an instructor at the Labor Relations and Research Center at UMass-Amherst, writes at The Washington Spectator.

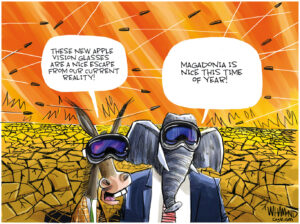

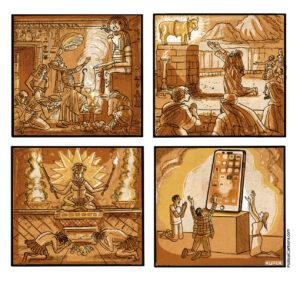

Nonfinancial corporations are the culprits here. Technology superstar Apple leads the way with nearly $150 billion in cash reserves. The resulting investment shortfall, Reuss writes, “is at the core of the sluggish ‘recovery’ and chronically high unemployment.”

Reuss offers a solution: a tax on this “idle cash that would light a fire under corporations to spend it now.”

“If focused on expanded production and new investment,” Reuss writes, “such spending would help close the still-enormous gap between the economy’s current production and its potential. And it could help boost employment, which has hardly grown (relative to the working-age population) during our current sluggish recovery.”

“The cash-reserves tax, if done right, would be an elegantly double-edged policy. If corporations still won’t spend their cash hoards, the tax would boost government revenue—which could be used to address human needs, build infrastructure, etc. (If corporations won’t invest, the government will.) On the other hand, the companies could avoid the tax by spending the idle cash, increasing output and employment.”

— Posted by Alexander Reed Kelly.

Your support matters…Alejandro Reuss at The Washington Spectator:

Mihir Desai, a professor at Harvard Business School, proposed a tax on “excess cash reserves” in a 2010 Washington Post op-ed and alluded to it again in congressional testimony the following year. Recently, the Financial Times’ Martin Wolf called for a “punitive tax on retained earnings” to spur investment. (He wrote this about Japan, but has suggested this policy more generally.) Overall, however, this idea has, so far, not made much of an impact on public debates.

Desai views a cash-reserves tax as a solution to a “coordination problem.” This means a situation in which individuals act rationally (from their own vantage point), yet their decisions add up to an “irrational” (undesirable) overall outcome. Low investment in a depressed economy is a classic example: No single company can affect overall demand in the U.S. economy very much. As long as demand is weak, then, it makes no sense for any one company to expand its current production or future capacity. Therefore, low investment creates a vicious circle of low demand, low output, and high unemployment. A cash-reserves tax would increase the cost of not investing. By spurring new spending, it would create the demand needed to justify the new investment.

Despite record profits and rampant corporate tax avoidance, public debate has focused largely on yet more tax cuts for big corporations. In part, this is because big business speaks with a giant megaphone. In recent congressional testimony, Apple CEO Tim Cook blamed U.S. corporate taxes for Apple’s huge offshore cash hoards. Economists, commentators, and politicians have echoed calls for a repatriation “tax holiday.” This shows how thoroughly the bias in favor of corporate tax cuts has permeated the political mainstream.

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.