A Look at the Presidential Candidates’ Tax Returns

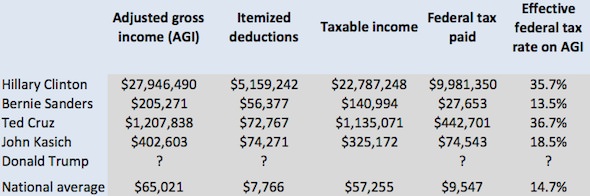

With the exception of Donald Trump, the presidential candidates have released their 2014 tax returns to the public. What can we learn from them?

Jane and Bernie Sanders. (Flickr)

Monday was the deadline for filing federal tax returns. The presidential candidates are also making tax-related headlines, as four of the five have already released their 2014 tax returns to the public. The takeaways? Bernie Sanders (who has made headlines for his low income compared to the rest of the 2016 candidates) pays the least, thanks to significant deductions. The Clintons, on the other hand, pay a 35.7 percent tax rate (compared to the average national rate of 14.7 percent).

Yahoo Finance reports:

Many taxpayers lower their payments to Uncle Sam through a variety of deductions, which is why almost everybody pays a lower effective tax rate than the tax bracket they fall into based on their gross income. The most popular deductions are the ones for mortgage interest, real-estate taxes, state and local income taxes and charitable donations. Those are listed on Schedule A of the candidates’ tax returns as itemized deductions; we’ve provided the overall total in the table above. There are lots of other types of possible deductions as well. Bill and Hillary Clinton operate at least two incorporated entities that are included on their personal returns, with many business expenses that are deductible. It’s harder to tell what deductions Ted Cruz and John Kasich claim, since they’ve only released the first two summary pages of their returns and not a breakout of the details.

It also breaks down the Clintons’ gross income, noting that Hillary received $10.5 million in 2014 for speeches alone. They also “donated $3 million to the Clinton Foundation.” That donation is tax-deductible because the foundation is nonprofit. Interestingly, the Kasichs “earned twice as much as Bernie and Jane Sanders in 2014, while paying nearly three times as much in federal taxes.”

Donald Trump has yet to release his own tax returns because they are being audited by the IRS. Yahoo Finance notes that nothing “prevents Trump from releasing pre-audited returns” but that he may choose not to do so because he benefits from certain tax breaks.

–Posted by Emma Niles

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.