4 Ways We Can Boost Wages and Radically Remake Our Economy

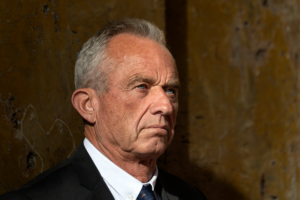

Most Americans can't afford a $500 emergency. A series of adjustments to the Earned Income Tax Credit can provide relief to millions. Former Secretary of Labor Robert Reich. (YouTube screen grab)

Former Secretary of Labor Robert Reich. (YouTube screen grab)

The challenges are well known: Working Americans are struggling to keep up with the increasing cost of living. Unemployment is low, but wages of most Americans have remained flat. More than three-quarters of Americans are now living paycheck to paycheck. Most can’t afford a $500 emergency.

There’s a simple and bold solution that would cost about as much as the Trump tax cut. But instead of helping corporations and the rich, it would help millions of working and middle-class Americans by putting money directly in their pockets.

I’m talking about expanding something called the Earned Income Tax Credit, or EITC. And although it’s been around for decades, it can be the basis of a revolutionary change in the lives of millions of people.

As it now stands, the EITC gives thousands of dollars to the working poor, with the amount of money they receive gradually decreasing as their earnings rise until they reach a cap, which is now a little over $50,000.

It works so well because it directly boosts the incomes of people who need it the most. Cash gives people freedom and dignity— the power to decide, for example, whether to have their car repaired or buy new shoes for their kids or save for a rainy day.

When working people have money to spend, they spend most of it in the communities they live in. This, in turn, causes businesses to hire more people to meet the demand. It’s a virtuous cycle that lessens poverty, makes the tax code fairer, and boosts the overall economy.

A bold new idea would be to expand this successful program in four simple ways:

First: Raise the maximum amount that very poor Americans receive from the Earned Income Tax Credit by several thousand dollars. This would dramatically reduce poverty in all families with someone who works full time.

Right now, a job at a $15 minimum wage plus Medicaid and food stamps still doesn’t meet basic needs in much of America. Raising the Earned Income Tax Credit would ensure that every family with a full-time worker is out of poverty.

Second: Extend the Earned Income Tax Credit into the middle class, so even families earning the median family income – which was just about $76,000 in 2017 – will benefit. This would be a huge help to working-class families, many of whom are now one paycheck away from poverty.

Third: Expand the benefits of the Earned Income Tax Credit to two groups of Americans who are working hard but not necessarily collecting paychecks: people (most of whom are women) who are caring for a child or for a senior in their family, and low-income students.

Fourth: Let people receive this money each month rather than in a lump sum once a year at tax time, so it helps with monthly expenses – rent, food, education – or can be saved to build a financial cushion.

Presto. We create a kind of cost-of-living refund to lift the incomes of a third of Americans, the people who need it most, and we also include the working class and lower middle class.

At the same time, we begin to rewrite the tax code in favor of ordinary Americans, instead of large corporations and the wealthy.

Eighty-three percent of the benefits of the Trump tax cuts will go to the top 1 percent of Americans by 2027. Expanding and modernizing the Earned Income Tax Credit can help put things back in balance.

It’s simple. It’s fair. It’s necessary. It’s big and bold. Enlarge and expand the Earned Income Tax Credit.

Your support matters…

Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.