7 Bold Elizabeth Warren Proposals That Would Remake America

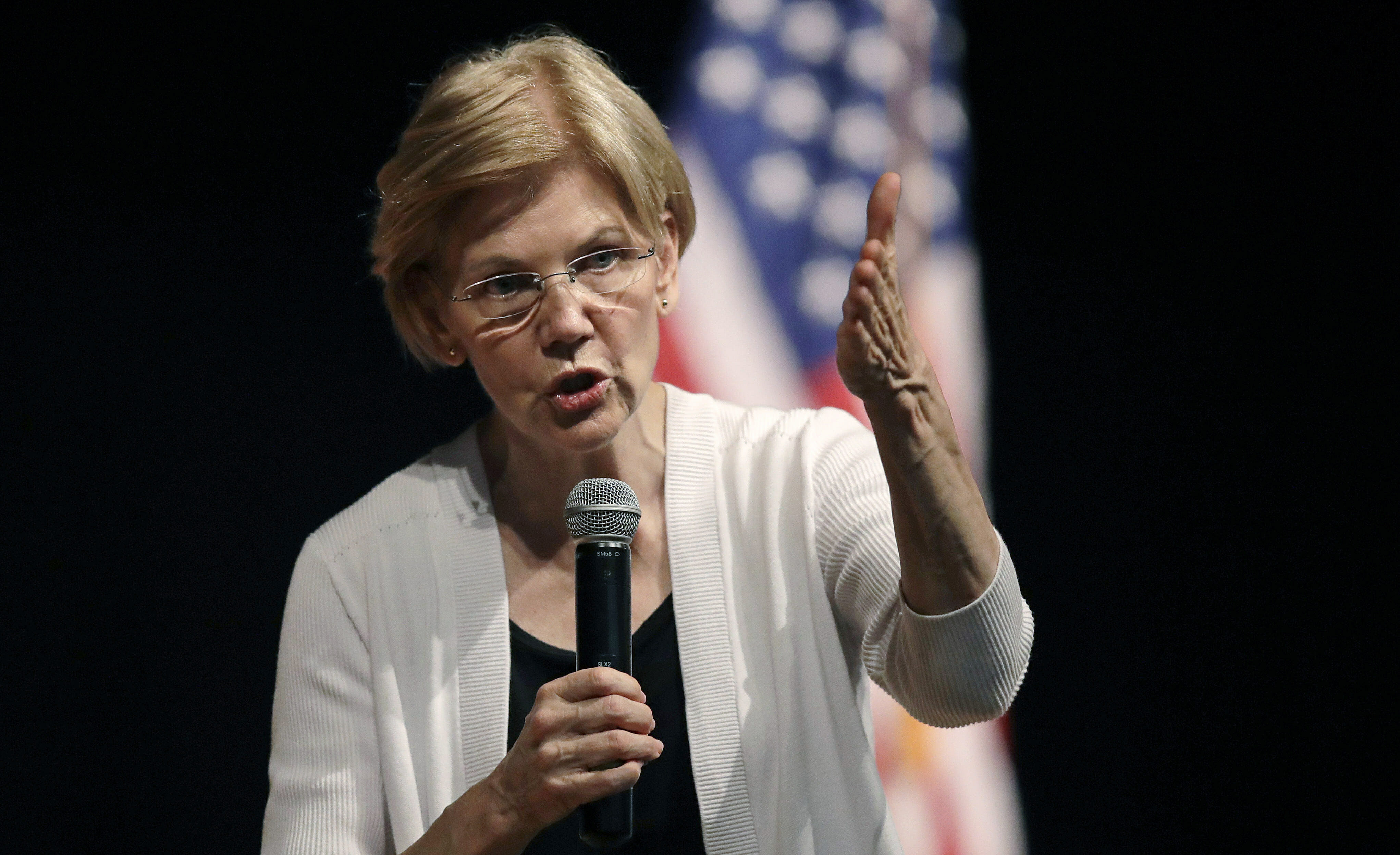

The senator has distinguished herself this election cycle with a series of policies would level an increasingly tilted playing field. Charles Krupa / AP

Charles Krupa / AP

The spotlight has escaped her thus far this election cycle, but Sen. Elizabeth Warren, D-Mass., has nonetheless distinguished herself in a crowded Democratic field as a woman of substance.

Buried by student debt? She has a plan for that. Want to work but can’t afford child care? She’s got you covered. Victimized by a rigged economic system, corporate greed and income inequality? Check, check and check, Warren’s on it in a big way.

Throughout her nascent campaign, the Massachusetts senator hasn’t just presented an aspirational vision of the country but furnished a detailed roadmap how we get there. This begins with her proposed wealth tax, which 60 percent of respondents in the most recent Quinnipiac University national poll said they supported.

Taken together, these policy ideas are revolutionary in their scope, with a particular emphasis on creating an economic playing field that benefits more than just the rich.

As David Leonhardt recently wrote in the New York Times, “Warren is trying to treat not just the symptoms but the underlying disease.” And as CNBC’s John Harwood points out, “a 2020 debate about average families’ struggles to get ahead plays to Warren’s strengths as a bankruptcy scholar, consumer advocate and second-term senator. … Warren has set the pace for the field on detailed policy ideas.”

Here’s a look at some of Warren’s boldest policy proposals to date:

- Wealth tax

Critics will invariably intone, “But how would we pay for all these programs?” Warren’s answer comes in the form of a wealth tax targeting estates worth $50 million and above at 2 percent a year, with an additional surcharge of 1 percent on those worth over $1 billion.

This shift from taxing income to taxing accumulated wealth “represents a more substantial rethinking of the federal government’s approach to taxation than anything a major presidential candidate has proposed in recent memory,” according to The New York Times.

- Wipe out student loan debt

In what Warren describes as “truly transformational,” she proposes canceling up to $50,000 in student debt, which would offer instant relief to an estimated 42 million Americans working to repay their college loans. The Massachusetts senator expects that her plan would “provide at least some debt cancellation for 95 percent of people with student loan debt (and complete and total student debt cancellation for more than 75 percent).”

Warren recognizes that the burden of student loan debt is, in her words, “crushing millions of families and acting as an anchor on our economy. It’s reducing homeownership rates. It’s leading fewer people to start businesses. It’s forcing students to drop out of school before getting a degree. It’s a problem for all of us.”

- Eliminate college tuition

Warren’s plan calls for two-year and four-year public college educations to be free of tuition and fees. As she wrote at Medium, “Once we’ve cleared out the debt that’s holding down an entire generation of Americans, we must ensure that we never have another student debt crisis again. We can do that by recognizing that a public college education is like a public K-12 education—a basic public good that should be available to everyone with free tuition and zero debt at graduation.”

In a recent interview with CNN, she revealed that this proposal goes further than the free college plan she and her 2020 primary rival Sen. Bernie Sanders, I-Vt., put forward in 2017.

“It covers more and it addresses both the access question of going to college and the problem of the debt burden for our students,” Warren said.

- Child care for all

The Universal Child Care and Early Learning Act, which Warren introduced in February, calls for a network of government-funded care centers to guarantee high-quality child care and early education for all pre-school-age kids. The centers would be free to any family that makes less than 200 percent of the federal poverty line, which Warren says will mean free coverage for millions of children. For families over that threshold, the sliding-scale rates are capped at no more than 7 percent of that household’s income.

For Warren, this policy proposal is personal. While announcing her plan, she revealed that parenting two small children nearly forced her to quit her teaching job over child-care concerns until her aunt came to her rescue, pointing out that “not everyone is lucky enough to have an Aunt Bee of their own.”

- Break up tech giants

Warren has proposed undoing mergers by large tech conglomerates like Facebook, Amazon, Google and Apple through existing antitrust laws. She also seeks to designate “platform utilities” so that no single company can control a given marketplace. This means that dual entities like Amazon Marketplace and Amazon Basics would be split apart, for example.

Warren claims these companies have “bulldozed competition, used our private information for profit, and tilted the playing field against everyone else.” By increasing competition in the tech field, her plan would force Facebook and others “to compete as aggressively in key areas like protecting our privacy.”

The New York Times, reporting on the proposal’s rollout in March, said Warren “compared Amazon to the dystopian novel ‘The Hunger Games,’ in which those with power force their wishes on the less fortunate.”

- Lowering housing costs

Approaching the issue of high housing costs as one of supply and demand, Warren’s housing act in the Senate calls for spending $50 billion annually to help local governments ease the shortage of affordable residences and families make down payments. As Warren and CNBC have pointed out, Moody’s Analytics concluded the plan would add 3 million new affordable units, reduce rental costs by 10 percent and create 1.4 million jobs within a decade.

The Atlantic notes, “The sheer scale of the bill, along with its focus on structural racism and government responsibility, places Warren’s brand of populist progressivism on full display.”

- Tax corporate ultra-profits

Warren proposes a 7 percent tax on corporate profits above $100 million, which would raise an estimated $1 trillion from the country’s wealthiest businesses, Bloomberg reports. The “Real Corporate Profits Tax” would contain “no loopholes or exemptions” and would include profits earned in the U.S. and abroad, eliminating tax avoidance via offshore accounts.

“Amazon reported more than $10 billion in profits and paid zero federal corporate income taxes,” she wrote in a Medium post announcing her plan ahead of Tax Day. “Occidental Petroleum reported $4.1 billion in profits and paid zero federal corporate income taxes. In fact, year after year, some of the biggest corporations in the country make huge profits but pay zero federal corporate income taxes on those profits.”

p

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.