We Need Elizabeth Warren on the Supreme Court

Jul 16, 2014 Elizabeth Warren is uniquely positioned to revive the flagging spirits of the left, and help restore the country’s confidence in the Supreme Court, which has sunk to record lows.

Gag Me With Lawrence Summers

Jul 30, 2013 President Obama thinks his former economic adviser is brilliant, but as Summers' second trip through the revolving door between Washington and Wall Street reveals, he's just greedy.

A Treasury Department Fail, ‘SNL’ Takes on Biden, and More

Jan 29, 2013 A look at the day's political happenings, including a bipartisan agreement reached on immigration reform and Obama and Clinton give a joint interview on "60 Minutes." A look at the day's political happenings, including a bipartisan agreement reached on immigration reform and Obama and Clinton give a joint interview on "60 Minutes."

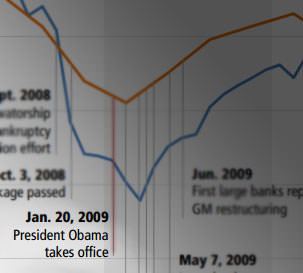

Why Bailouts Will Continue Until the Big Banks Are Broken Up

Jan 9, 2013 TARP -- the infamous Troubled Assets Relief Program that bailed out Wall Street in 2008 -- is over. The Treasury Department announced it will be completing the sale of the remaining shares it owns of the banks and of General Motors. But in reality it’s not over.

Truthdigger of the Week: Ex-TARP Investigator Neil Barofsky

Aug 5, 2012 In late 2008, Neil Barofsky was appointed the Treasury Department’s investigator of the bank bailouts. In the time since, he has suffered dismissal and deprecation from his colleagues and the corporations they're supposed to regulate.Since he was appointed to investigate the bank bailouts in 2008, Neil Barofsky has suffered dismissal and deprecation from his colleagues and the banks they're supposed to regulate.

Fallout From the Bungled Bank Bailout

Jul 23, 2012 The financial meltdown and subsequent bailout have dampened Americans' faith in government and stirred widespread outrage. Neil Barofsky, who once served as special inspector general in charge of oversight of the Troubled Asset Relief Program, says that anger may point the way toward reform.

Why the Senate Won’t Touch Jamie Dimon

Jun 21, 2012 JPMorgan Chase is the biggest campaign donor to many of the members of the Senate Banking Committee who were charged with investigating the bank's CEO, Jamie Dimon, in mid June.

Treasury Projects a Profit From Bailout

Apr 16, 2012 Just as Mitt Romney has locked up the Republican nomination on a boast of fiscal conservatism, President Obama's Treasury Department has said it expects to turn a tidy $2 billion profit from TARP and other extraordinary measures taken to bail out the financial industry.

A Closer Glance at the Fed Audit, Please

Dec 7, 2011 It's been available for almost six months now: the first independent audit of the Federal Reserve. In case you haven’t read it top-to-bottom, former Congressman Alan Grayson, who petitioned the study along with Rep. Ron Paul, wants to draw your attention to some of his favorite parts.

The Bernanke Scandal: Full-Frontal Cluelessness

Jun 8, 2011 How I wish that Ben Bernanke would get caught emailing photos of his underwear-clad groin. Otherwise we don’t stand a chance of reversing this administration’s economic policy, which is shaping up to be every bit as disastrous as that of its predecessor. How I wish that Ben Bernanke would get caught emailing photos of his underwear-clad groin.